Poles are in much less debt than before the pandemic. Although after a deep collapse in the number and value of loans granted in the initial months of the lockdown, the following months have already brought a gradual rebound, loan sales are still well below the average of the last 2 years. Does this mean that we are dealing with greater consumer caution and moving away from the broadly defined consumerist lifestyle, in favour of tightening the best and well-thought out spending only on necessary purposes? To answer this question, we have taken a closer look at cash and instalment loans.

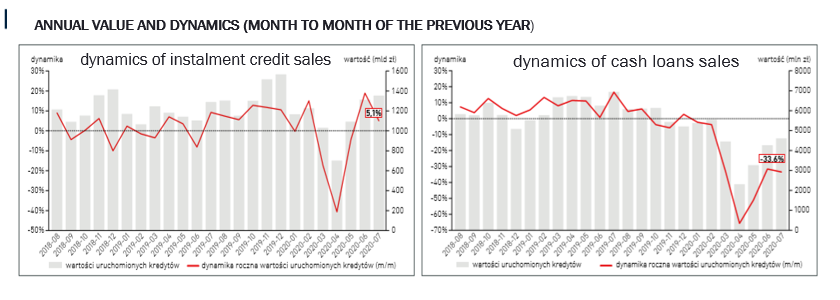

According to BIK data, sales of cash loans in the period from January – July 2020 fell by -33.6% in value terms and -32% in number terms compared to the previous year. Although the decrease was driven mainly by sales of high value loans, i.e. above PLN 50k ((-36.3%) in terms of number and (-38.1%) in terms of value), the dynamics from the low value range loans up to PLN 1k was also negative (-11.6% in terms of number and (-14.1%) in terms of value). The above data indicates that not only the number of loans granted in the individual ranges is decreasing, but also their average value (the average value in July is PLN 17,699 – a decrease of 2.3% compared to July 2019).

The situation looks best in installment loans (in terms of number (-0.8%) and in terms of value (3.8%), and in the range of PLN 2-5 thousand the dynamics is in fact positive), although according to experts the reason for the different trend is a different nature/ purpose of this form of lending – cash loans are mostly used to supplement the household budget, and installment loans – to purchase consumer goods.

According to Santander Consumer Bank data, in 2019 the most popular products purchased with such financing were respectively:

smartphones (160 thousand), washing machines (60 thousand), TVs (50 thousand), vacuum cleaners (20 thousand).

The average value of instalment loans is also growing (the average value of the instalment loan is PLN 4,624 , which translates into an increase of 3.9% compared to July of last year). So, can we talk about Poles turning away from consumerism and being in debt to purchase goods that are not necessary to function/living?

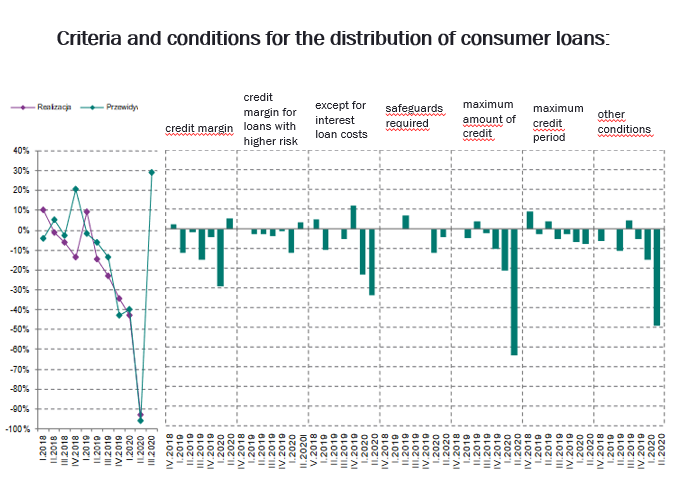

A drop in cash loans may indicate this, but the stable situation in instalment loans already contradicts it – after a momentary crash at the very beginning of the lockdown, instalment loans are doing well. So perhaps there is another reason for this and it is related to the approach of financial institutions to provide loans to consumers? Partly for sure, according to NBP data in Q2 2020, the criteria for granting consumer loans were tightened (-93%)* mainly by lowering the maximum amount of of the loan(-64%), increasing the cost of loans (-34%) and shortening the maximum loaning period (-8%). The main reasons for greater conservatism among banks were uncertainty about further economic developments (-89%) and other factors not covered by the direct question from the survey, among which the increase in risk related to the effects of the pandemic was mentioned as the most important.

*The survey results are presented in the form of structures, i.e. the percentage of banks that have chosen a given option to answer particular questions. The banks’ answers are weighted by the share of a given bank in the market segment to which the question relates. The values given rather illustrate a certain tendency resulting from the aggregated statements of bank representatives for the questionnaires conducted by the NBP. Detailed explanations concerning the methodology are available here: https://www.nbp.pl/systemfinansowy/rynek_kredytowy_2020_3.pdf

Source:

https://media.bik.pl/publikacje/read/556328/newsletter-kredytowy-bik-lipiec-2020-r-najnowsze-dane-o-sprzedazy-kredytow-w-polsce

https://infowire.pl/generic/release/556325/newsletter-kredytowy-bik-lipiec-2020-r-najnowsze-dane-o-sprzedazy-kredytow-w-polsce#attachments

https://www.nbp.pl/systemfinansowy/rynek_kredytowy_2020_3.pdf

https://www.egospodarka.pl/162055,Zakupy-na-raty-dlaczego-kupujemy-glownie-smartfony,1,39,1.html