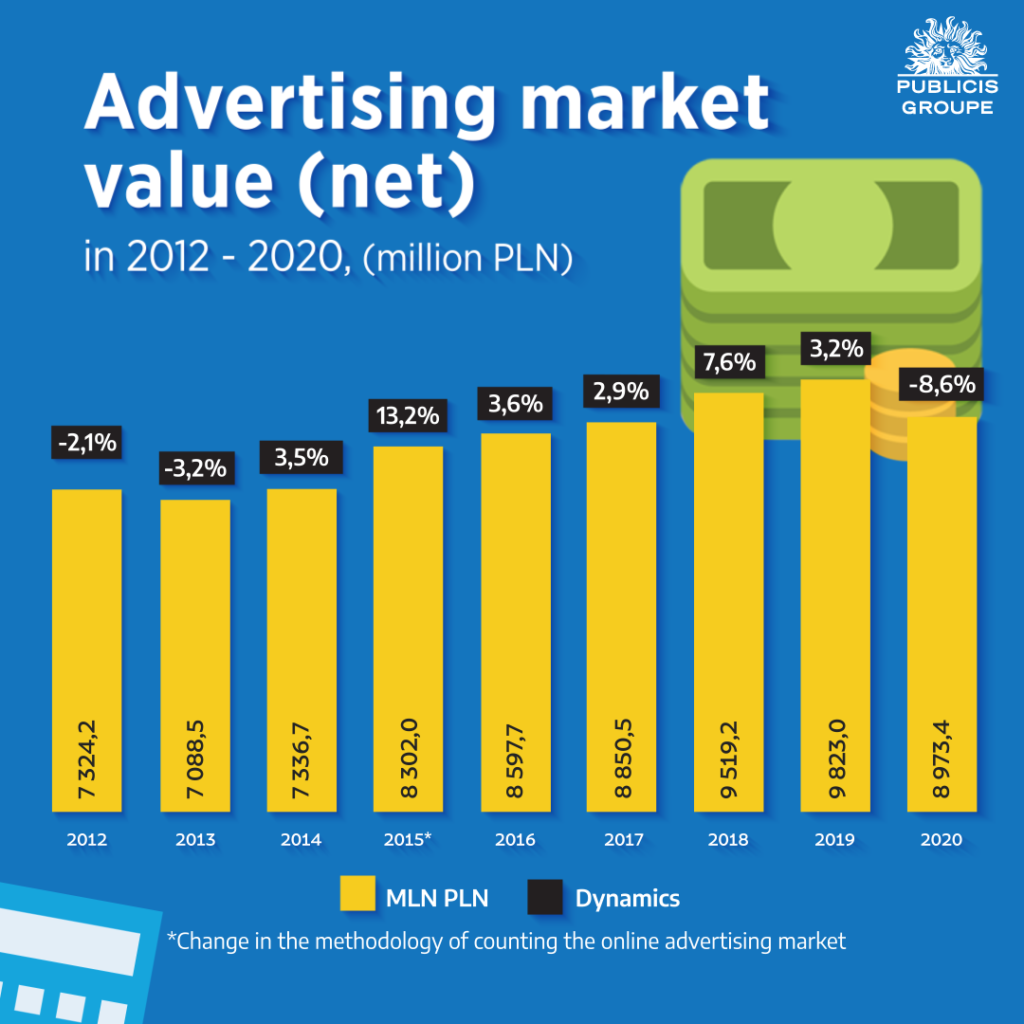

The value of the advertising market in Poland in 2020 amounted to PLN 9 billion, down 8.6%.

- Advertisers are moving budgets to the Internet.

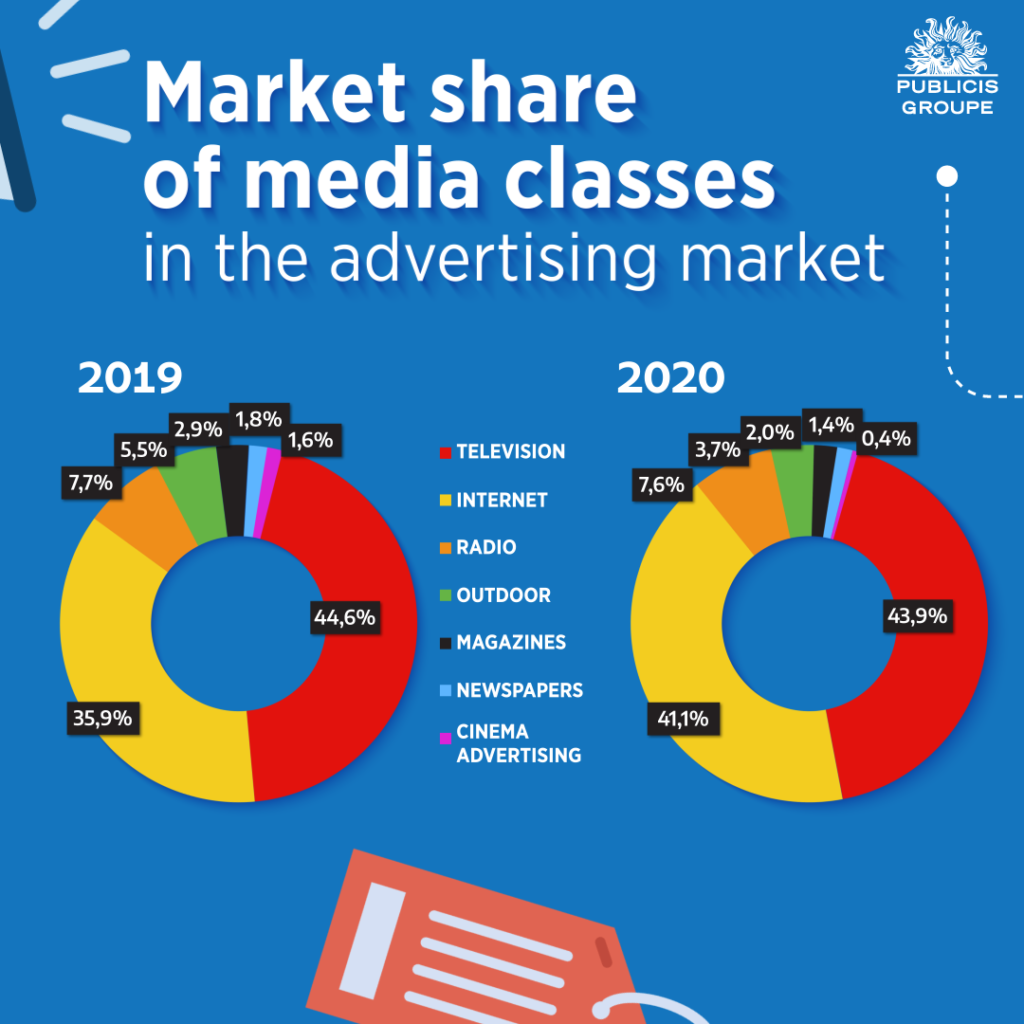

- The internet increased its market share to 41.1%.

- The share of TV and Internet increased from 81% in 2019 to 85% this year.

- TV advertising spending decreased by 10.1% or PLN 443 million.

Chart 1. Net value of the advertising market in the years 2012-2020

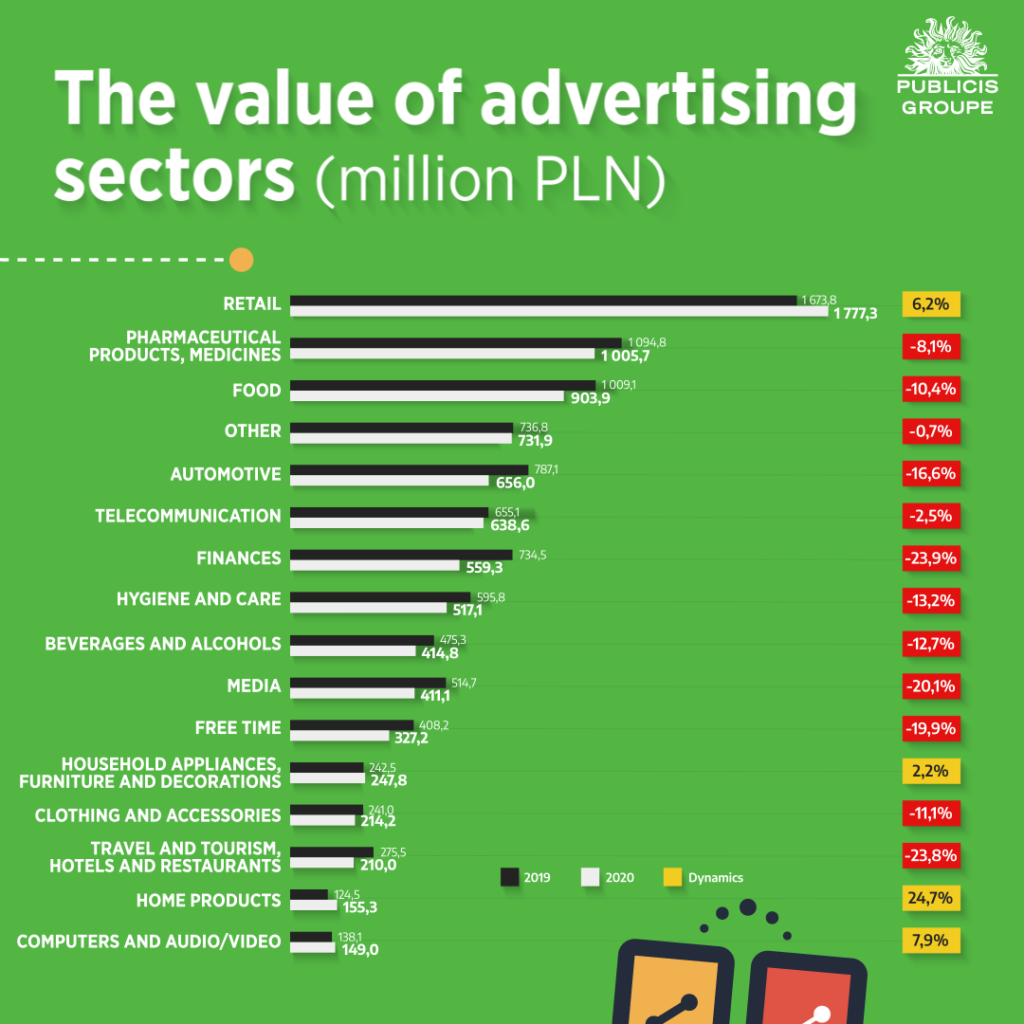

ADVERTISING SECTORS

After four quarters of 2020, the advertising market in Poland decreased in value by 8.6% compared to the previous year. Twelve sectors reduced their advertising investments and only four intensified. Advertising spending increased in the largest sector, i.e. retail – by 6.2% and in the three smallest sectors: computers and audio video (+7.9%), household products (+24.7%) and home appliances, furniture and decor (+2.2%). The largest volume declines affected three sectors: finance, food and automotive. In the financial sector, advertising expenses were very much limited by loan institutions such as Provident or Creamfinance. Among banks, the greatest reduction was observed in Credit Agricole, PKO BP and BNP Paribas. Decreases in the food sector were mainly caused by budget reductions in categories such as: chocolate and chocolate products; cakes, pastries, bars, ice cream and snacks. As far as advertisers are concerned, Ferrero, Unilever, Wawel Krakow, Wedel spent much less than a year ago. In the automotive industry, the advertising expenses were the most limited by the brands of passenger cars, among others: Volkswagen, Skoda, Toyota, Opel. In the category of petrol stations, we observed an increase, thanks to the large expenses of PKN Orlen.

Chart 2. Expenditure of individual advertising sectors, 2020 vs 2019

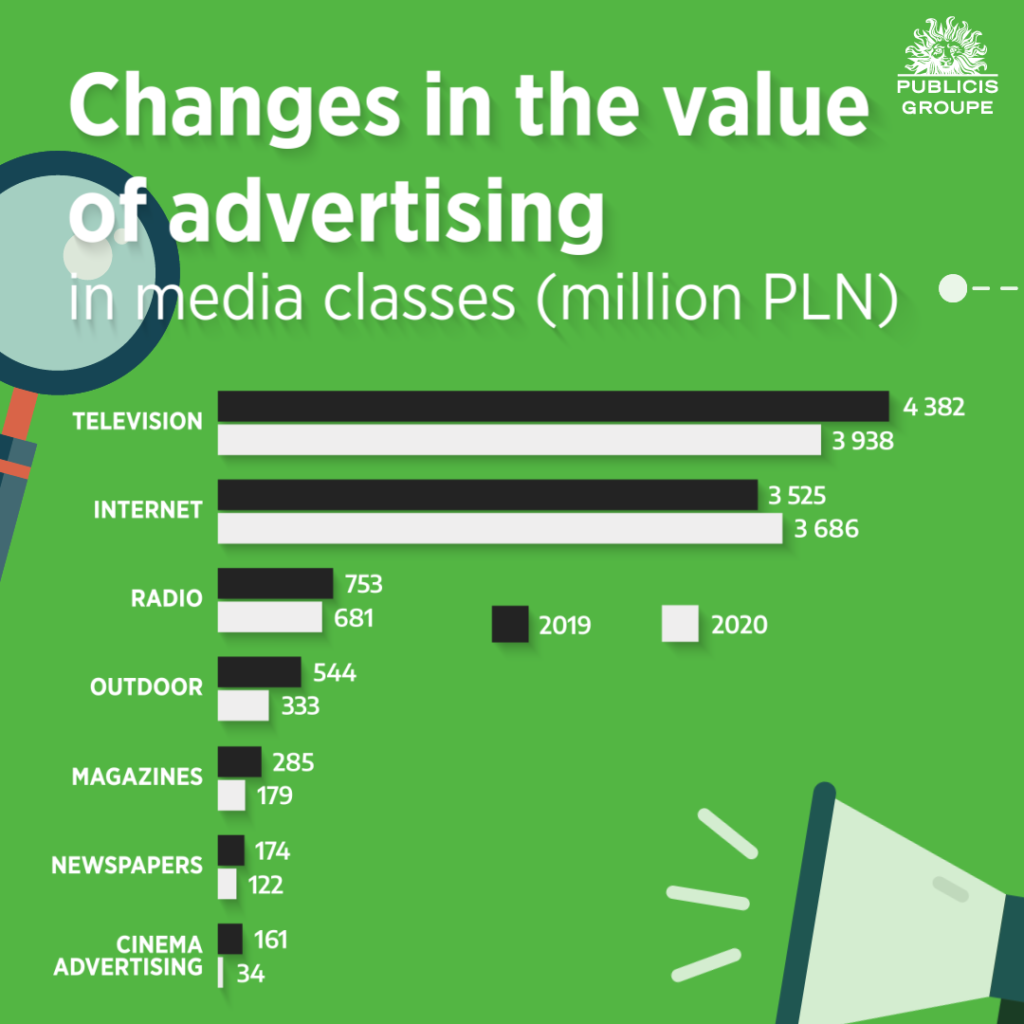

COMMUNICATION CHANNELS

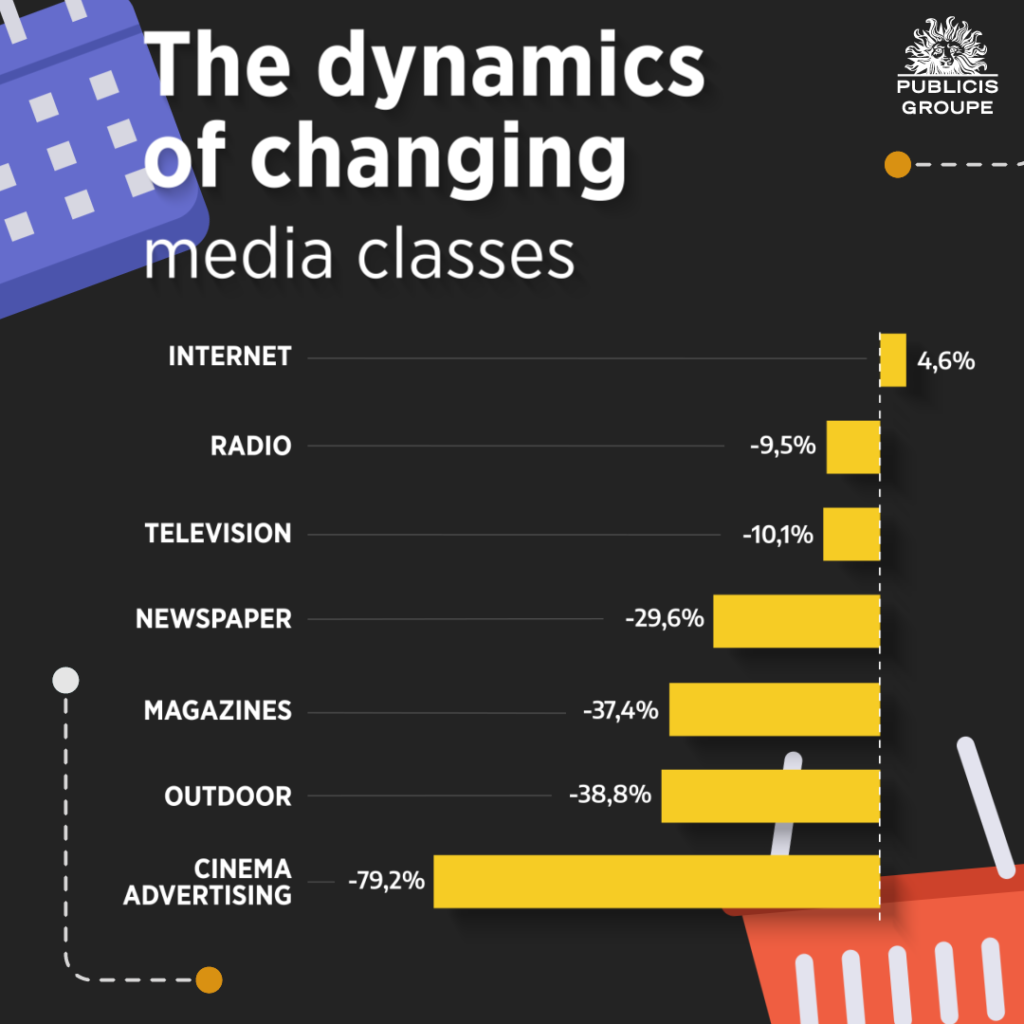

After twelve months of 2020, all media except for the Internet recorded declines. Online advertising generated an inflow increased by 4.6%. Television and radio lost 10.1% and 9.5% respectively, while dailies and magazines lost 29.6% and 37.4%. Cinemas recorded the strongest negative growth – advertising spending was 79.2% lower than in the previous year as a result of the government’s decision to temporarily suspend cinema operations from March 12 of last year. The cinemas opened in August, then closed again on November 7 and did not open again until the end of 2020.

Internet budgets increased by PLN 160.8 million. The total reduction of expenses in the legacy media was over PLN 1 million. In terms of amount, television lost most – the collapse of the market in Q2 resulted in the total revenues of TV stations after twelve months being lower by as much as PLN 443.1 million compared to the previous year.

Chart 3. Changes in the value of advertising in the media classes between 2019 and 2020

Chart 4. The dynamics of changes in media classes, 2020 vs 2019

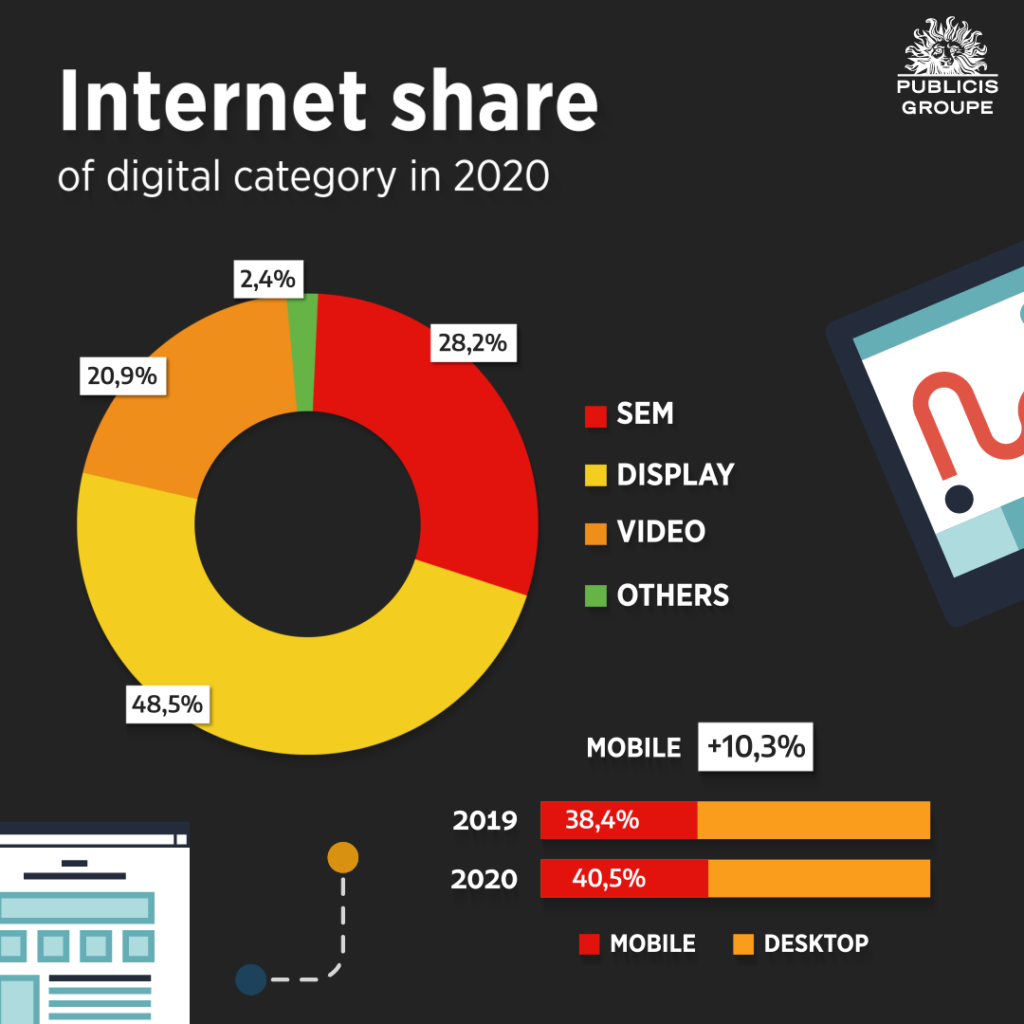

The value of expenditure on internet ads (not including advertisements) increased in 2020 by 4.6%, giving the result of PLN 3.7 billion , i.e. PLN 160.8 million more than last year. In Q2 of this year, for the first time in its history, the Internet recorded a decrease in advertising investments (-6.9% after data revision), however, Q3 and Q4 meant a return to the increase in spending. The pandemic contributed to strengthening the Internet’s position in the advertising market and accelerated the flow of spending from other media. Some of the budgets not used in press, cinema and outdoor advertising were transferred to digital.

Chart 5. Share of individual advertising categories in digital advertising spending in 2020.

TV budgets fell by PLN 443.1 million, or 10.1%, in 2020. The end of the year was quite good for the medium – in the fourth quarter, spending grew by 2.4%. In fact, from July last year, the market began to return to relative normality. Advertisers have learned to function in the new pandemic reality. They have adapted their communications to the situation and, despite restrictions and the economic downturn, are not cutting back on their TV advertising investments. The fight for customers is particularly fierce in trade. In 2020 this sector spent PLN 74 million more than in the previous year. Large increases in budgets were recorded for such companies as Żabka, Vinted, Euro RTV AGD or OBI. After twelve months of 2020, radio budgets amounted to PLN 681.5m, down 9.5%. In Q2, radio was strongly affected by the pandemic – advertising spending was reduced by over 40% in April and May. In the second half of the year, the market stabilized – in Q3, the value of budgets decreased by only 2.5%, and in Q4 by 4.2%. According to the latest wave of Kantar Polska Radio Track, the average daily radio reach in the 15-75 age group in 2020 decreased by 3.3 percentage points in relation to the previous year. Reach generated in the car decreased the most. Poles travel less due to the pandemic, both on the way to work and on leisure trips.

In 2020, advertising revenues of outdoor operators fell by 38.8% or PLN 210.8 million. Q2 was the biggest crisis in OOH’s history of successful monitoring. More than 2/3 of budgets disappeared from the market. The next months brought a slight improvement, but neither traffic in cities nor advertising budgets returned to the previous year’s level. For example, the Warsaw ZTM reported that in September this year the number of passengers accounted for about 62% of the pre-pandemic travelers. Similar declines were reported by Gdansk (about -30%). After four quarters of 2020, the size of budgets allocated in newspapers and magazines decreased by 29.6% and 37.4% respectively. Q2 alone was even worse for printed media. The decreases were 43.8% and 56.6% respectively. Autumn and the holiday season were not much better for the press, which does not allow to look optimistically into the future. The pandemic accelerated the trend of the outflow of advertising budgets from print to Internet and it seems that advertisers will not return to print with bigger budgets this year. As of March 12, cinemas stopped generating revenues due to the government’s decision to temporarily suspend cultural institutions. The cinemas operating under the new rules could be reopened on June 6. All the cinema chains decided to open at a later date. The Helios chain opened at the beginning of July, while Multikino and Cinema City cinemas all over Poland did not open until 22 July. The cinemas were shut down again on November 4. According to the government’s decision, audiences could return to cinemas as of February 12, 2021, but the big chains decided not to open on that day. Maintaining cinemas is expensive and the situation with the pandemic is still very difficult. There is no certainty that the government will not shut down the cinemas again in a few weeks. In addition, new movie premieres are being held up, and without them, audiences will not return to watch the big screen.

Media share in advertising revenue

As a consequence of different dynamics of changes in particular media classes, their market share is changing. After four quarters only the value of investments in online advertising increased. That is why the Internet has increased its share in the media mix. In Q2 alone, for the first time in history, Internet spending exceeded spending on television. In the entire analyzed period, the percentage of budgets allocated to online advertising increased by as much as 5.2 percentage points from 35.9% to 41.1%. Other media decreased their share in the media mix. TV, cinemas and outdoor lost a lot, with 0.7 percentage points, 1.3 percentage points and 1.8 percentage points respectively.

Chart 6. Share of media classes in the advertising market, 2020 vs. 2019

Comment by Iwona Jaśkiewicz-Kundera, Chief Investment Officer Publicis Groupe:

“The value of the advertising market in Poland in 2020 amounted to PLN 9 billion, down 8.6%. The weakest months in terms of dynamics were April and May – decreases by more than 30% are the effect of the lockdown and the crisis caused by COVID-19. In the second half of the year, we observed a normalization of the situation and a return of advertising budgets almost to the levels of the corresponding period of 2019 – Q3 recorded a 3% decline and Q4 a decline of just over 1%. For the whole of 2020, only ad budgets placed online were higher compared to 2019 by 4.6%, other media were definitely more affected by the pandemic. Television and radio lost 10.1% and 9.5% respectively, while dailies and magazines lost 29.6% and 37.4%. Cinemas recorded the strongest negative growth – advertising spending was 79.2% lower than in the previous year as a result of the government’s decision to temporarily suspend cinema operations from March 12. The cinemas opened in August, then closed again on November 7 and did not open again until the end of 2020.

The vast majority of advertising sectors reduced their advertising investments, among those that grew were retail (up 6.2%), computers and audio video (+7.9%), home products (+24.7%) and home appliances, furniture and decor (+2.2%).

The most difficult year in over a decade is behind us, taking into account the economic situation and the situation in the advertising market. In terms of GDP dynamics, 2020 was the worst year since the beginning of keeping the statistics. However, despite the pandemic and continuous changes in restrictions, the 2.8% GDP decline was better than forecast and one of the smallest declines in Europe. This year will certainly bring a rebound. The November NBP forecast assumes that Poland’s GDP will grow by 3.1%. A similar forecast is made by the European Commission.

The first two months of this year and information from advertisers about this year’s budgets indicate that the advertising market in 2021 will grow, according to our estimates, by 6.4%. The next, third wave of the pandemic has not caused major changes in advertising budgets and, unless the situation worsens, we should observe increases in Internet, TV and radio budgets in the coming months.”