McKinsey analyzed data provided by MIYA – China’s leading mobile payment provider – from 31,000 stores and over 500 million transactions conducted by over 100 million people from 150 cities, including Wuhan and Hubei. Data before, during and after the pandemic was compared, and on this basis, conclusions were drawn. With a certain level of generality, they could be applied to the post-pandemic reality in other countries.

- Offline purchases are slowly returning to their pre-lockdown levels – during the peak, they dropped to 39% to gradually recover to around 79% of primary consumption. Height of coronavirus infections resulted in the sales’ rise for hypermarkets, convenience stores (CS) and pharmacies. Hypermarkets have already returned to a normal level of sales. Of course, traffic in stores has fallen, but the value of the basket has increased and remains high, e.g. in CS peak + 120%, after peak + 49%.

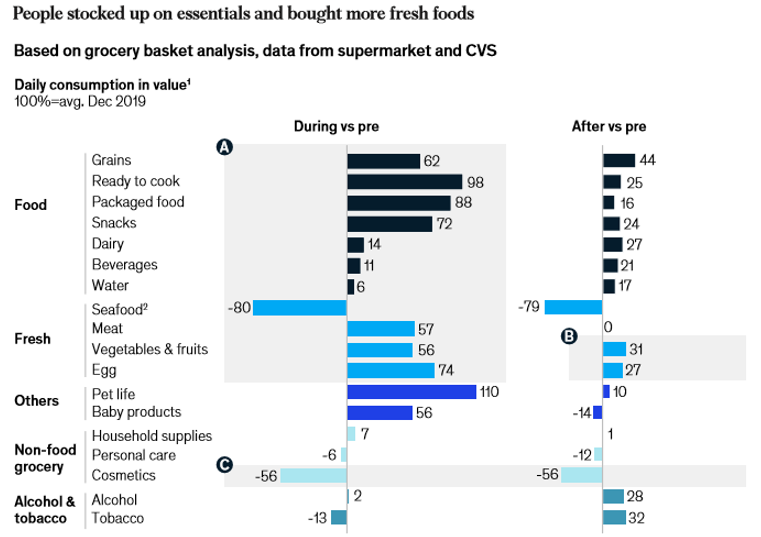

- The “healthy” categories, i.e. vegetables and fruits, recorded the most massive increase. Unlike, for example, ready meals, their increased consumption continues, remaining at a level about 1/3 higher than in the “before” times, these categories have become part of new eating habits, associated with a different way of preparing food.

3.More than usual, Chinese consumers during the lockdown, tried new things, including other stores and brands. 45% tried new brands because they were more available, 37% because of security i

issues, and 32% because of price or better quality. It is estimated that 20% will stick to these new choices for longer.