On the eve of loosening restrictions and opening up the possibility of vaccinating the next generation, when we are all already dreaming of a “post-covid reality” where we can drink wine in a restaurant, go to the cinema or theater and go on vacation, WARC has published a report gathering knowledge on the covid year. This very interesting compilation shows the scale of changes in spending on particular media around the world. And while the report tends to instantiate our intuitions and observations of the Polish market, it is always good to know how the local situation relates to global trends.

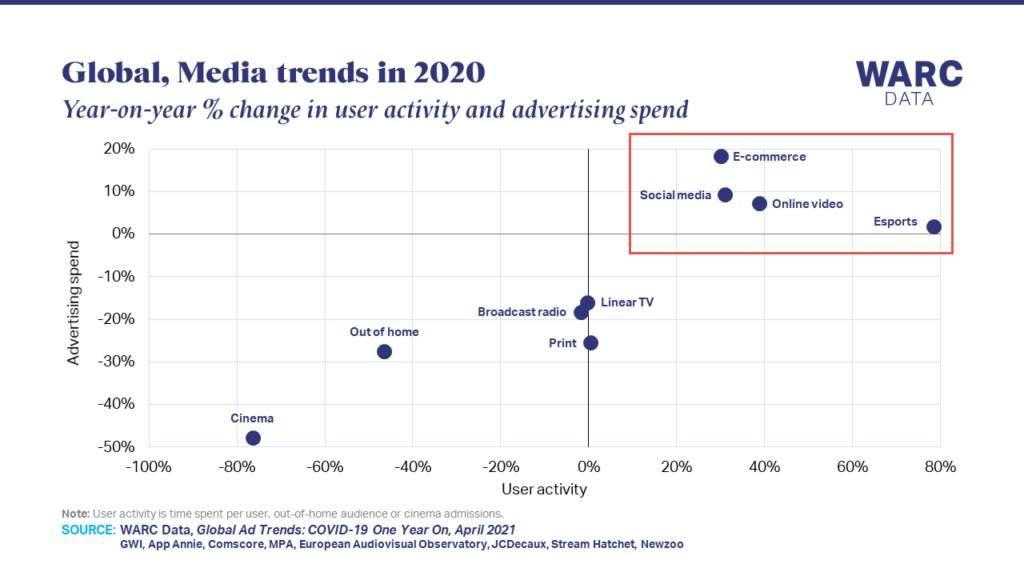

It’s a cliché, but WARC’s data show it conclusively: the unprecedented changes in media habits as a result of Covid-19 were won by digital media, and according to analysts this will continue – with a focus on agility, innovation and efficiency in 2021. The channels that were able to find their way in this reality were of course e-commerce platforms, social media with an emphasis on TikTok, online video (where YouTube reigns supreme… but not in Germany) and e-sports. The biggest losers were of course cinemas and OOH. It is interesting to note that in press, TV and radio, spending globally fell by about 20%, but user activity in these media did not change. So in these shifts we see both a kind of fashion and a search for new, innovative solutions that can strongly engage and/or directly influence sales.

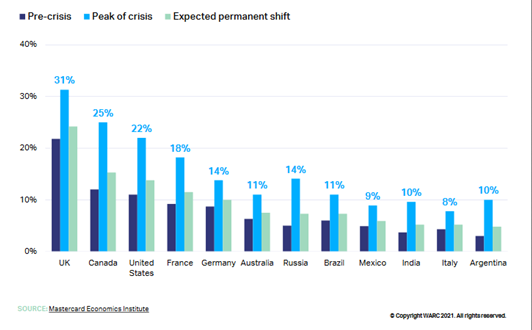

E-commerce has grown 30 times faster than online advertising. Mastercard’s analyses show that in every market, the pandemic increased e-commerce’s share of total trade value (with the UK, for example, at almost 1/3, Canada at ¼, and Russia at only 14%), but after the pandemic and other retail outlets open, a continued shift in consumer habits towards e-commerce is expected. And while this will depend on the industry (which, according to analysts, is expected to be more resistant to, for example, the automotive industry), it is also estimated that as much as 75% of the shift in consumer habits to digital grocery shopping will be permanent. That is why big retailers such as Lidl or Carrefour have to develop this branch – change is inevitable here.

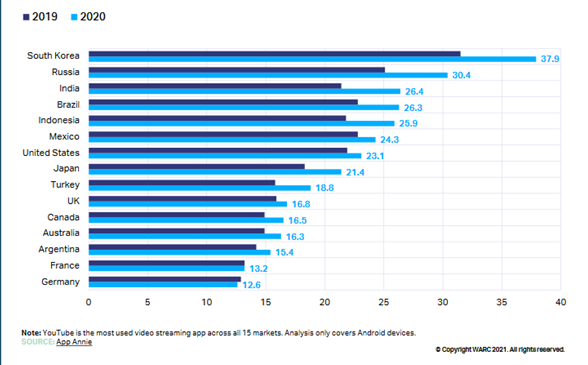

On-line video is linearly “eating” TV, with YouTube and other platforms becoming the main providers of content. In almost every country surveyed (on Android devices), monthly YouTube consumption increased in 2020 relative to the previous year by a few-odd percent – the exceptions being France, where it didn’t change… and Germany, where YouTube viewing in 2020 was slightly less than in 2019.

This, of course, says a lot about the changes in preferred video programs also in other media (shorter, more intensive portions of content), shows the power of youtubers (recently channelized in Poland e.g. by the Koral brand) and draws attention to the shopping possibilities of these formats (shoppable video is one of the most important trends for 2021).

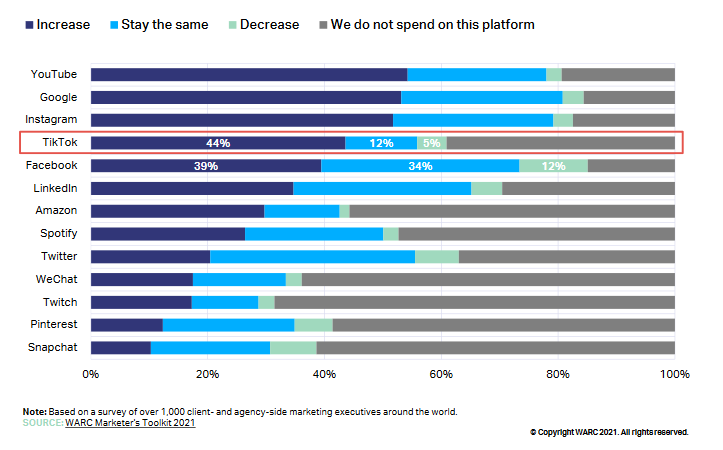

TikTok won the pandemic – the number of users doubled in 2020, and the platform’s built-in social shopping capabilities that clearly shorten the conversion funnel are gaining interest from a growing number of marketers. In 2021, decision makers surveyed by WARC listed TikTok as the fourth platform on which they plan to increase media spend (after YouTube, Google and Instagram). It is worth noting that the leader among the platforms on which spending reductions are planned is… Facebook.

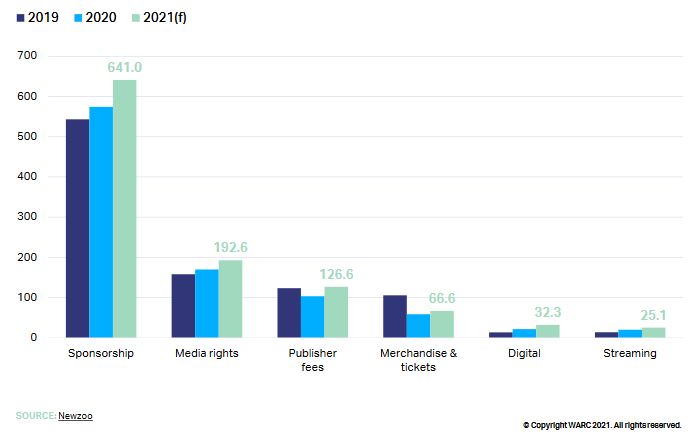

The pandemic was also won by gaming and eSports, which in 2020 crossed new sponsorship boundaries (USD 600 million), proving that it is a media phenomenon like any other and that it is possible to be present there with brand experience in a variety of ways. However, it is worth remembering that 1/3 of decision makers do not want to invest in this channel – citing a lack of standardization, lack of control over brand safety, and better insights from other channels as reasons.

You can read the entire report can on the WARC platform, https://content.ascential.com/global-ad-trends-covid-19-one-year-on-tyou.html