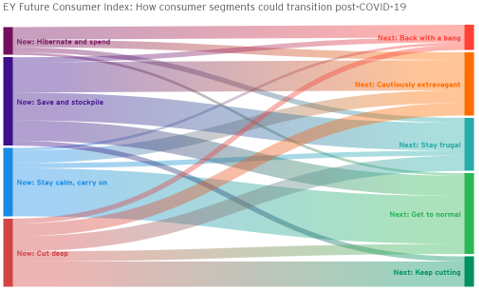

At present, everyone more or less agrees that the pandemic has significantly impacted consumer behaviour and that these changes will be permanent in many dimensions. The “EY Future Consumer Index” study, conducted on the American, Canadian, British, French and German markets provides interesting data in this regard. It describes four consumer segments during a pandemic:

„Save and stockpile” – The largest segment includes 35% of consumers who are not so concerned about the pandemic and at the same time quite pessimistic about the long-term effects.

„Cut deep” – 27% of consumers: hardest hit by the pandemic, most pessimistic about the future and spending less across all categories.

„Stay calm, carry on” – 26% of consumers, not directly impacted by the pandemic, not changing their habits.

„Hibernate and spend” – last (11%) segment most concerned about the pandemic, but best positioned to deal with it. Optimistic for the future, spending more across the board.

Each segment shows some changes related to spending in different categories, interestingly, almost all segments (except “deep cut”) spend more on food. These consumers – who are mainly over 45 – have been hit the most and are curbing spending across all the categories. 78% of consumers in this segment are shopping less frequently, and 64% are only buying the essentials. At the same time 33% feel brands are now far less important to them.

However, the EY project goes further by constructing five segments that will emerge as a direct consequence of the pandemic crisis. Those are:

„Get to normal” – 31% of consumers with daily lives never really affected, and spending habits largely unchanged. Only 29% say it will have changed the way they shop, and only 21% what they buy.

„Cautiously extravagant” – 25% of consumers with middle to high income. Despite having a strong belief that we will be in a global recession after the pandemic and being financially conservative, they expect to spend more on non-essential categories important to them (i.e. entertainment, health, restaurants, or fashion). But 45% believe that how they shop will have changed permanently, and 38% say the same about what they will buy. They respond strongly to purposeful brands, with 62% saying they would be more likely to purchase from companies that they feel are doing good for society.

„Stay frugal” – 22% of consumers, who are the most pessimistic, however trying to get back on their feet. Spending slightly less, but some deep cuts.

„Keep cutting”- 13% least educated, least likely to be working. Making deep spending cuts.

„Back with a bang”- 9% younger and in work. Their daily lives were most disrupted, at the same time, spending much more in all categories.

source: https://www.ey.com/en_gl/consumer-products-retail/how-covid-19-could-change-consumer-behavior