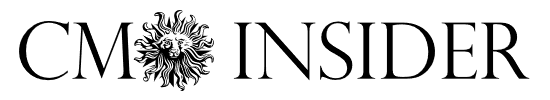

The value of the advertising market in the first three quarters of 2023 was close to PLN 8.3 billion and was higher by 7.1% compared to the same period last year. According to the latest Advertising Market Report published by Publicis Groupe Poland, investments grew in online advertising, television, radio, outdoor, cinema and in newspapers, while they decreased in magazines.

- The share of the internet in the advertising market remains at the level of 45%, while television fell – below 40%

- The value of expenditure on digital advertising increased by 8.2%, or nearly 281.5 million PLN

- The value of expenditure on television advertising increased by 4.6%, or almost 142.1 million PLN

- The share of radio, cinema and outdoor advertising, as well as online, increased

- The sector with the highest volume of spending growth remains the trade sector

Chart 1. Value of the net advertising market after the first three quarters in 2013 – 2023

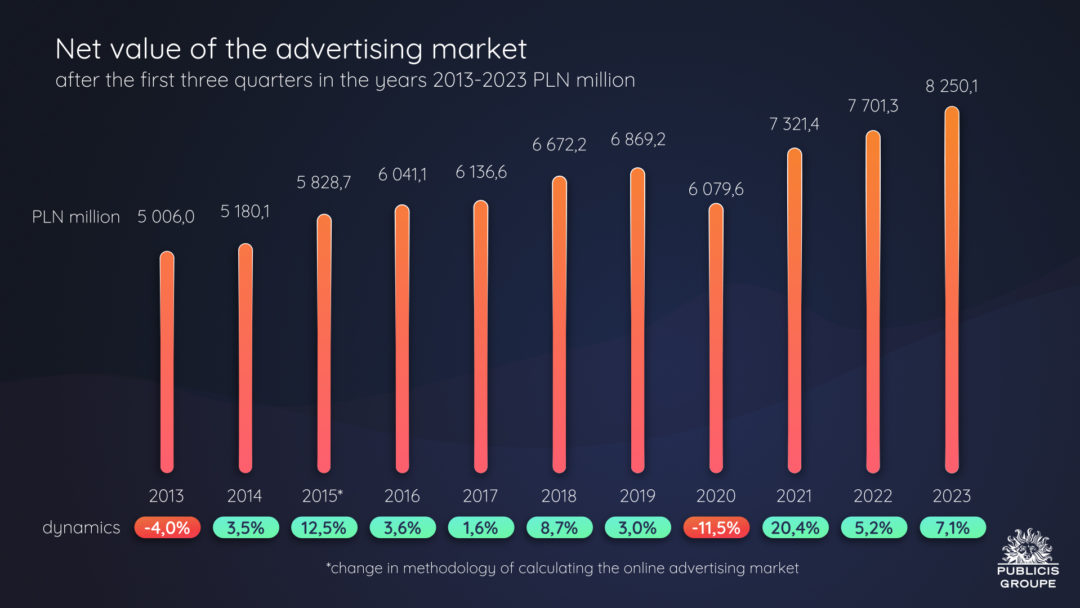

ADVERTISING SECTORS

In the first three quarters of 2023, the advertising market in Poland increased its value by 7.1% compared to the same period in 2022. As many as twelve sectors increased advertising investments, and four made budget reductions. The largest volume of expenditure growth was generated by the trade sector – trade companies allocated over PLN 193.5 million more for advertising, which represents an 11.8% year-on-year growth. Among the leaders of expenditure, we can find the company TERG – owner of Media Expert stores, the Lidl chain, and Jeronimo Martins. The largest decrease in the volume of advertising investments, however, took place in the media sector – companies from this sector allocated over PLN 48 million less for advertising (dynamics -10.1%). The leaders of expenditure in this sector in the discussed period are: Skyshowtime Limited, Kino Świat and The Walt Disney Company. The second sector in terms of the volume of expenditure growth was the automotive sector, which in the first three quarters of 2023 increased advertising investments by almost PLN 91 million (dynamics 24.1%). The leaders of expenditure in this industry are: Volkswagen Group Polska, Polski Koncern Naftowy Orlen and Toyota Motor Poland. In third place in terms of the volume of expenditure growth was the pharmaceutical sector. Pharmaceutical manufacturers increased advertising investments in the discussed period by PLN 75.2 million (dynamics 9.3%). Among the largest advertisers in this industry are: Aflofarm Farmacja Polska, USP Zdrowie and Natur Produkt Zdrovit.

Chart 2. Expenditure of individual advertising sectors, 2023 vs 2022

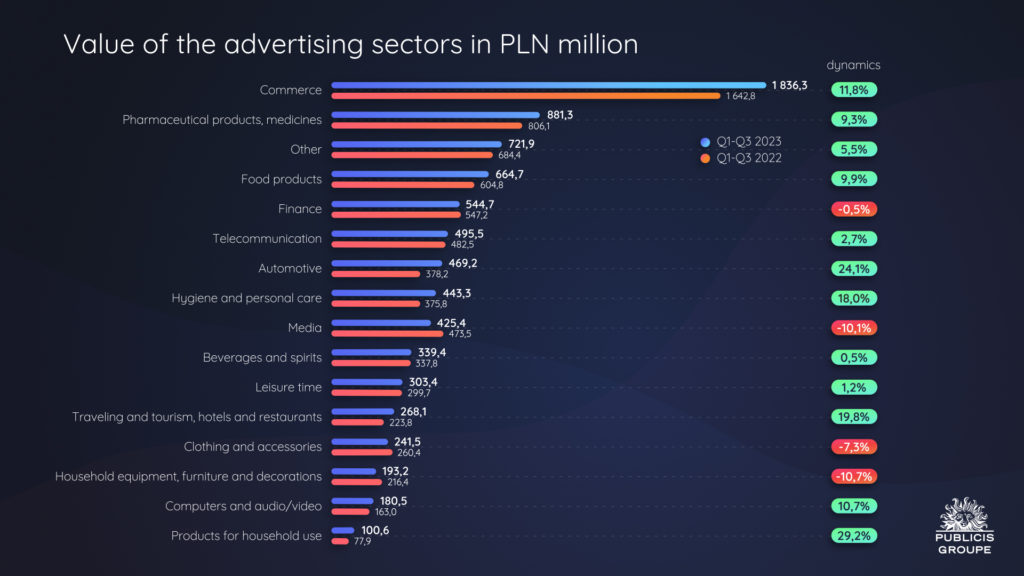

COMMUNICATION CHANNELS

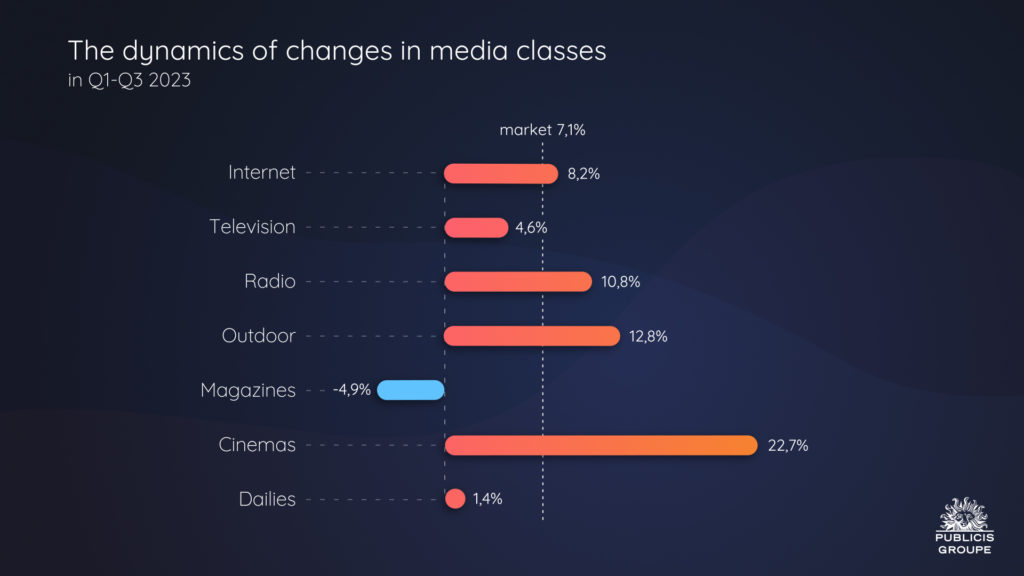

In the first three quarters of 2023, advertising investments increased in the internet, television, radio, outdoor advertising, cinema and newspapers. Similar to the first half of the year, expenditure on magazines decreased. The fastest growing are still cinema advertising expenditure – over 22.7% (in volume terms, this was more by PLN 21.8 million than in the previous year). The second fastest dynamic can be boasted by outdoor, thanks to a 25% increase in the third quarter. Radio is also accelerating, after another strong quarter it remains the driving force of the entire advertising market. In addition, investments in the internet, whose dynamics also remain higher than the market, have translated into strengthening the advertising market. The volume analysis shows that internet budgets have increased by over PLN 280 million. Television is also not slowing down. In volume terms, television investments increased by over PLN 140 million. A positive dynamic was also recorded in newspapers, due to a ten percent increase in the third quarter. The only medium with a negative dynamic after three quarters of 2023 are magazines, with a decrease of nearly PLN 6 million.

Chart 3. Changes in the value of advertising in media classes in 2022 – 2023

Chart 4. Dynamics of changes in media classes, 2023 vs 2022

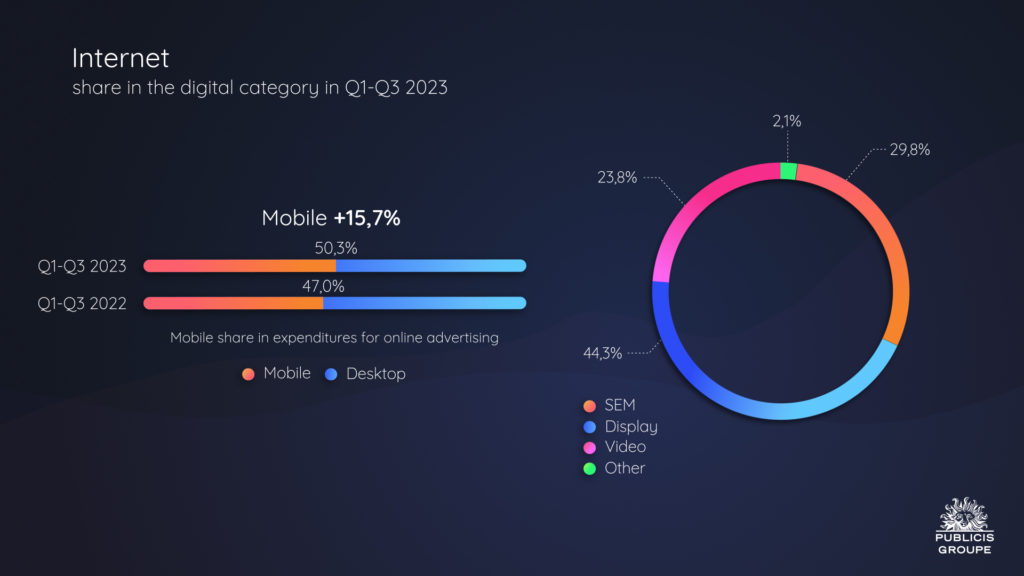

In the first three quarters of 2023, the internet was the largest medium in Poland in terms of advertising revenue. According to Publicis Groupe’s analysis, from January to September 2023, the value of advertising investments on the internet (not including expenditure on advertisements) was nearly PLN 3.7 billion, which means an increase of 8.2% year on year. In addition, the share of the internet in the advertising market increased to 44.8%, and the difference between the share of the internet and television was 6 percentage points. Video advertising grew the fastest – by 20.1%, slower in search engines – by 11.4%, and display advertising recorded a slight decrease in dynamics by 0.4%. From January to September 2023, 65% of adcontacts generated by digital advertising came from the mobile channel. At the same time, during this period, the share of mobile advertising in online advertising revenues exceeds 50% and is higher than last year by 3.3 pp. Publicis Groupe’s analysis shows that after three quarters of 2023, the value of advertising budgets allocated to mobile increased by 15.7%. The third quarter of 2023 was the second in a row when Google recorded an increase in global advertising revenues, by 9.5%, thus after three quarters global advertising revenues increased by 4.2%. During this period, global SEM revenues increased by 6.0%, and from YouTube by 4.8%, while GDN revenues decreased by 5.3% (source: Alphabet stock market report). Meta, on the other hand, increased global revenues by 23.5% in the third quarter, giving a 13.2% increase after three quarters. In Europe, Meta recorded the second consecutive growth quarter, with dynamics reaching 35.3%, giving an increase of 15.3% after 9 months. Recently in Europe, Meta has been struggling for the condition of its business with the European Data Protection Council. By decision of this institution, which safeguards the personal data of EU citizens, Meta is to stop using behavioral data about users to display personalized ads to them. In response to this, Meta introduced a subscription model for its Facebook and Instagram services. If users do not want to pay for access to the services, they must agree to be shown personalized ads.

Chart 5. The share of individual advertising categories in digital advertising expenditure in the first three quarters of 2023

The size of the television advertising market from January to September 2023 was estimated by Publicis Group analysts at over PLN 3.2 billion, which means an increase of 4.6% year on year. The increase in revenue is due to the continued high demand for advertising campaigns on TV. At the same time, the available advertising inventory is shrinking: from January to September 2023, the number of generated ratings decreased by 4.4% year on year (spots, in home+OOH, EqGRP A16-59). In the first three quarters of 2023, the average TV viewing time (ATV) was over 15 minutes lower than the same period in 2022 (A1659). Viewers spent almost 3 hours and 15 minutes in front of the TVs, of which about half an hour was devoted to channels or signal sources that are not available as part of television advertising. In terms of the volume of growth in television budgets, the ‘other’ sector, mainly social advertising, was in first place (more by over PLN 36.4 million, dynamics 31.0%). In second place was the automotive sector, which increased budgets by PLN 33.2 million (dynamics 38.3%), a similar increase was estimated by Publicis Group analysts in the case of the hygiene and care sector (more by PLN 33.2 million, dynamics 15.0%).

Radio is currently enjoying great interest from advertisers and has had an excellent three quarters. Thanks to increased demand and inflation, advertising investments in this medium increased by as much as 10.8% over the first nine months of 2023 (i.e. by over PLN 57 million). The largest increase in budget volume was recorded in the case of the leader for the radio market, i.e. the trade sector – by almost PLN 25.7 million (more by 10.8%). The automotive sector returned to the radio advertising market – the second in terms of volume growth (more by PLN 13.6 million, dynamics 38.2%), and in third place was the ‘other’ sector – with an increase of PLN 13.0 million (dynamics 20.3%, mainly political institutions and social advertising increased their expenditure).

From January to September 2023, advertising investments in outdoor advertising were 12.8% higher than last year and, as in previous quarters, this growth was mainly generated on digital media. According to Publicis Groupe’s analysis, the share of digital media in advertising revenues increased from 17.6% in the first three quarters of 2022 to 23.2% in the same period of the current year. The largest volume increase in advertising investments occurred in the beverages and alcohol sector – by PLN 10.5 million (dynamics 80.1%). In second place was the telecommunications sector, which allocated over PLN 8.7 million more for outdoor advertising year on year (dynamics 29.9%). In third place in terms of volume growth was the travel and tourism, hotels and restaurants sector, with an increase of over PLN 6.3 million (dynamics 55.2%).

According to Publicis Groupe analysts, advertising investments in magazines decreased from January to September 2023 by 4.9%, i.e. by over PLN 5.7 million. The total area of advertising in magazines has decreased by 9.1%. The sector with the largest volume decrease was the media sector (less by PLN 2.6 million, dynamics -30.5%). The second in terms of volume decrease was the food sector, which reduced advertising investments by over PLN 1.3 million (dynamics -35.4%), and in third place – with a decrease of PLN 1.0 million – was the pharmaceutical products, medicines sector (dynamics -5.0%).

In the first three quarters of 2023, net advertising revenues in cinemas were estimated at almost PLN 118 million, which is 22.7% more than last year. Compared to the same period in 2019, i.e. the period before the crisis caused by the pandemic, the level of revenues in 2023 is already higher by as much as 18.6%. The top five sectors with the highest share in cinema advertising expenditure were: media, finance, automotive, trade, and travel and tourism, hotels and restaurants. In terms of volume growth, the automotive sector stood out, which increased advertising investments by over PLN 7 million (dynamics 108.0%).

In the period from January to September 2023, newspaper advertising investments grew year on year by 1.4%, which is about 1.2 million PLN. The sector with the most significant volume decline in advertising investments was the ‘other’ sector (being the largest sector advertising in newspapers, including business services, social advertising, foundations, political parties, real estate, and education), which increased its advertising investments by nearly 2.7 million PLN (dynamics 7.8%). The second largest in terms of volume growth was the travel and tourism sector, hotels and restaurants, for which the advertising budget increase reached almost 1.6 million PLN (dynamics 27.9%). In third place with slightly smaller growth was the clothing and accessories sector. Here the increase was 0.9 million PLN (dynamics 60.1%).

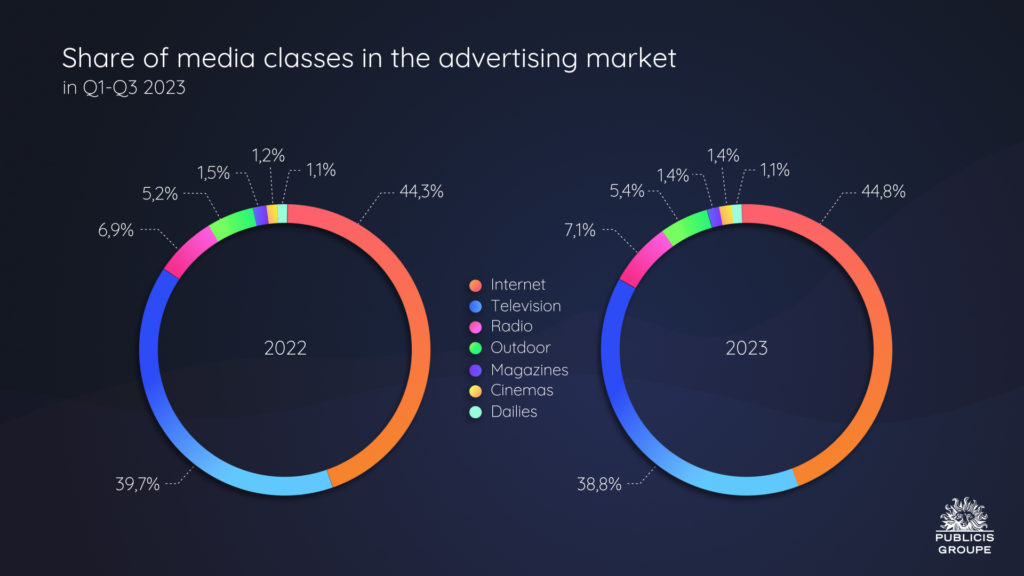

MEDIA SHARE IN ADVERTISING REVENUE

As a consequence of the diverse dynamics of changes in individual media classes, their market share also changes. Since the internet overtook television in 2021, we observe the strengthening of this trend every quarter. The internet’s shares in the media mix increased from 44.3% to 44.8%, while TV’s shares fell from 39.7% to 38.8%. However, not only the internet’s shares are growing. The share of radio continues to increase. Moreover, thanks to a good third quarter, outdoor advertising has improved its position.

After three quarters, the share of outdoor advertising was 5.4%, which was higher by 0.2 percentage points compared to the same period last year. Cinema continues to strengthen its position, having increased its share from 1.2% to 1.4%. The share of newspapers remained at the same level, while the share of magazines decreased from 1.5% to 1.4%.

Chart 6. The share of media classes in the advertising market, 2023 vs 2022

Comment by Iwona Jaśkiewicz-Kundera, Chief Investment Officer of Publicis Groupe:

The International Monetary Fund’s forecast for global economic growth remains at 3.0% in 2023 and 2.9% in 2024, which is significantly below the historical (2000-2019) average of 3.8%. IMF analysts predict that global inflation will steadily decline, from 8.7% in 2022 to 6.9% in 2023 and 5.8% in 2024, thanks to tighter monetary policy. The conflict in the Middle East in October added to the factors affecting the risk of further global economic growth, the impact of which on the global economy is difficult to estimate at this time. The National Bank of Poland in its latest, November projection for inflation and GDP lowered the expected GDP growth in 2023 from 0.6% to 0.3%. The inflation projection for 2023 is 11.4%, which means a decrease of 0.5 percentage points compared to the July projection, and the forecast for 2024 has been lowered to 4.6% from 5.2%. According to the Central Statistical Office, as part of the so-called “rapid estimate”, seasonally adjusted GDP increased by 1.4% in the third quarter compared to the second quarter and was higher by 0.5% year on year. This was therefore the first growth quarter after two, when we were dealing with a decline in GDP dynamics and the Polish economy was in a technical recession. The advertising market continued its growth trend in the third quarter and in the period from January to September 2023 it grew by 7.1% year on year.

From January to September 2023, advertising investments in the internet, television, radio, outdoor advertising, cinema, and newspapers increased, while they fell in magazines. The internet was again the largest medium in terms of advertising revenue, reaching a value of nearly 3.7 billion PLN, which means an increase of 8.2% year on year. The internet’s share in the advertising pie is approaching 45%, while television’s has fallen below 40%. In the case of television advertising, we recorded an increase of 4.6%, despite the still shrinking viewership. Moreover, in the third quarter, the advertising market saw increased demand for outdoor advertising, which resulted in a significant acceleration in the growth of this medium, after three quarters, investments in outdoor increased by 12.8%. Radio advertising also recorded double-digit growth after three quarters, which we estimated at 10.8%. Investments in cinema advertising increased by 22.7%, while newspapers recorded a 1.4% increase. At the same time, advertising investments in magazines decreased by almost 5%. Our forecasts for market development, adjusted after the first half of the year, still proved to be too cautious. The advertising market proved its resilience in the third quarter to uncertain sentiment, negative sentiment, and technical recession. In our opinion, 2023 may end with a 6 – 7% increase, especially in the face of high growth in the third quarter, we raised our assumptions for television, outdoor, and radio advertising.