Last week the third edition of the report by the Zenith agency’s Business Intelligence team was released. In this edition we made an attempt to forecast trends and dynamics of the Beauty & Personal Luxury category, which we will observe in 2021. After 2020 one thing we know for sure – reality can be even less predictable than we thought. A year ago, none of us expected to part with our current lifestyles and work for more than twelve months. Like our lifestyles, the pandemic has profoundly disrupted sales, communications and trends across all product and service categories worldwide. For some categories, it has proven to be a catalyst for long-awaited change; other industries have had to adapt dramatically to survive in the new reality. Can we even talk about any predictions for the future under such conditions? This is certainly not an easy task. To build effective communication and develop business in times of transformation, we need to look more closely than ever at trends and potential directions of development. What may be a niche phenomenon today may become a key growth factor tomorrow, defining market success or failure.

THE BEAUTY INDUSTRY HAS BLAZED NEW TRAILS IN ONLINE SALES

Faced with a completely new environment, some Beauty brands have become pioneers in using digital channels to communicate and sell products. These brands have dynamically developed online sales channels, giving consumers the opportunity and safe environment to test and purchase their products, while focusing on using digital media to effectively complement traditional communication channels: television and magazines. The category continues to be heavily dependent on traditional sales and communication channels, this is the key area where we can expect to see the most change and it is likely to determine the business success or failure of brands in the expected sales rebound in 2021-2022.

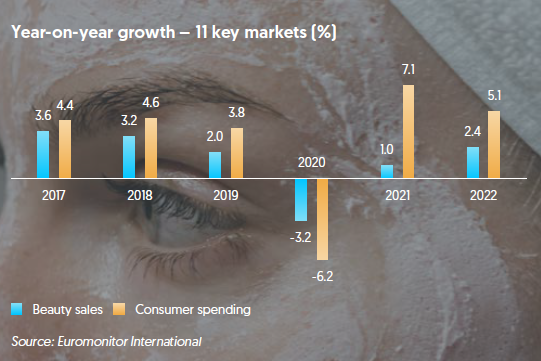

The demand for cosmetics and perfumes dropped quickly and sharply last year. This was due to a reduction in the number of meetings and opportunities to socialize. In contrast, the demand for skin and hair care products held up and even increased in some of the analyzed markets. This shows that consumers feel a stronger need than before to take care of themselves, to indulge in small pleasures on which they are able to spend the extra money they have in the new reality. Consumer behavior and moods have also changed. Beauty and luxury brands, more than ever, need to consciously address shoppers’ growing expectations regarding the environmental impact of their products, sustainability and social justice.

FORECASTS FOR 2021-2022

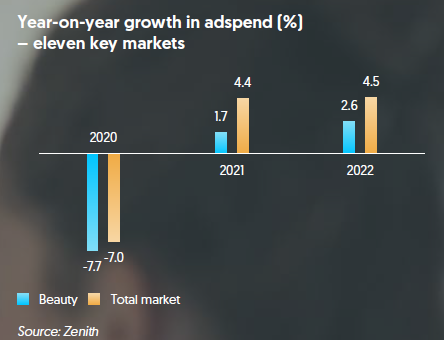

In the coming year, Zenith’s Business Intelligence analysts estimate that ad spend in the Beauty & Personal Luxury sector will grow by 1.7%, a result far below the growth rate of total ad spend in the 11 key markets covered in the report*, which is forecasted to grow by 4.4%. Beauty ad spending in these countries will reach USD 7.5 billion in 2021 and then exceed USD 7.7 billion in 2022, growing 2.6%, compared to a 4.5% growth for the overall market. The expected slower growth in spending for the overall market will reflect reduced demand for cosmetics and fragrances due to persistent social distancing rules. Despite the projected economic recovery, no major increase in demand for cosmetic products is expected. Consumers will gradually revert to pre-pandemic habits, which will translate into a decline in sales of cosmetics and perfumes, in particular. We can already see that a significant portion of cosmetic brands and luxury goods manufacturers are not increasing budgets, but rather shifting their spending towards more profitable communication channels.

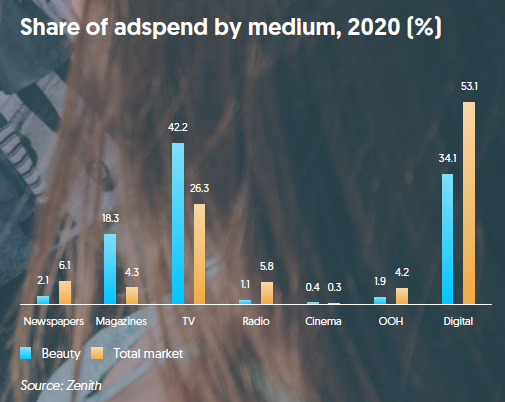

Beauty brands and luxury goods manufacturers have been relatively slow to embrace digital advertising, spending 34.1% of their budgets on this channel last year, compared to 53.1% for digital across the market. This is due to the fact that the Beauty category is an image category, often constrained by strict guidelines of fashion houses, and its communication is based on building emotional bonds through advertising in a high-quality context. The smaller share of digital media in luxury brand spending compared to the market is a result of the lack of premium space that would support a high-quality brand image, which is something that luxury product marketers and beauty brands constantly strive to emphasize. Limited spending in this channel also reflects consumer habits. Consumers still feel the need to try products in person. According to Euromonitor International, the e-commerce channel accounted for 11.8% of sales in the Beauty and Personal Luxury sector in 2019, compared to 13.2% for the overall market.

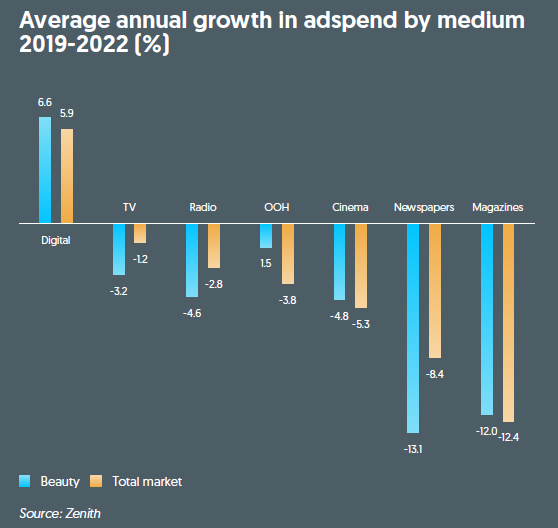

Therefore, it can be expected that the market situation and the desire to compensate for the under-invested communication of beauty and luxury goods brands will translate into a significant increase in spending in digital channels at the expense of declining spending in traditional media. BI analysts forecast that the average growth of digital expenditures in 2021-2022 will reach 6.5% in the Beauty category, and digital will be the only channel where these expenditures will increase in the next two years.

DIGITAL MEDIA AND TECHNOLOGY A KEY CATALYST FOR CHANGE

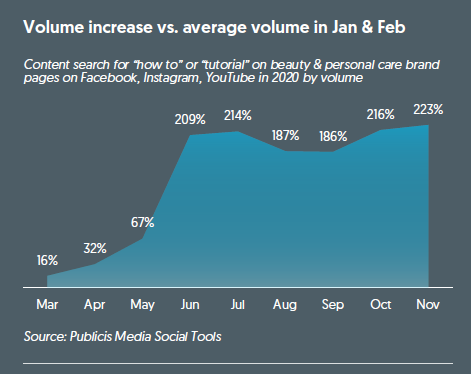

In pandemic times, our homes have not only become a home, office or school, but more often than not they have also replaced beauty salons or hairdressers. The natural consequence of more time spent at home and the limited availability of services is a definite increase in interest in tutorials. This is evident from the fact that searches for key phrases related to tutorials more than doubled in the second half of 2020, compared to January-February of last year. With the closure of perfume shops and beauty salons and the growing spending of the cosmetics and luxury categories in digital, digital media and technology will be a key catalyst for change in the way consumers test and purchase cosmetics.

China is the leading market in this regard. Retailers and brands have already successfully started using augmented reality, streaming, and social media en masse in 2019 to engage consumers and make online shopping more interactive, replacing the perfume shop shopping experience.

The absolute pioneer in using AR in the Chinese market is the Alibaba Group. Using YouCam Makeup’s augmented reality technology, they enabled consumers to test color cosmetics in their leading online stores over two years ago, which after just a few months caused the conversion rate in the color cosmetics category to nearly quadruple on Alibaba’s platform. Since then, augmented reality technology has been rapidly adopted by leading brands such as L’Oréal, Nars Cosmetics, and MAC.

While augmented reality tools still require advertisers to invest in the development or adoption of commercially available solutions, new sampling methods are challenging in terms of creativity. The declining potential of existing sampling methods in magazines makes it necessary to look for alternative, scalable solutions. An interesting example is Nars Cosmetics’ sampling campaign from the UK. The brand used the growing potential of streaming platforms and enabled Spotify users to order samples of products advertised on the platform, using the functionality of Google assistant and Amazon Echo (LINK). Another interesting product sampling idea was demonstrated by Lush, which decided to take advantage of the increased popularity of home shopping and food delivery services to encourage consumers to try their luxury line of soaps and encourage more frequent hand washing (LINK). A recent example that exploits, in turn, the ever-growing potential of gaming has been demonstrated by the Swedish Hjärta pharmacy chain . As part of its “Skin for Skin” campaign, it allowed Steam users to exchange their virtual skins for test sets of skin care products (LINK).

The COVID-19 pandemic proved to be a catalyst for the cosmetics and luxury goods category to change and exacerbate trends we’ve seen in the category for years. Catching up with under-investment, changing the media split toward higher-performing digital, or finally adopting AR on a massive scale and leveraging online sampling in the face of lingering principles of social distance and partial lockdown is more a necessary adaptation to new conditions than a revolution. What remains the biggest mystery is which players will best adapt their sales and communication channels by leveraging seemingly niche solutions that may prove to be the key growth drivers defining success in the age of digital category transformation in the coming years.

Compiled from the Business Intelligence: Beauty & Personal Luxury 2021 report, Zenith.

*The eleven markets included in the report are: Australia, Canada, France, Germany, India, Italy, Russia, Spain, Switzerland, the UK and the US, which together account for 59% of total global ad spend. Beauty and luxury goods are defined as a combination of four subcategories: cosmetics, perfume, hair care and skin care.