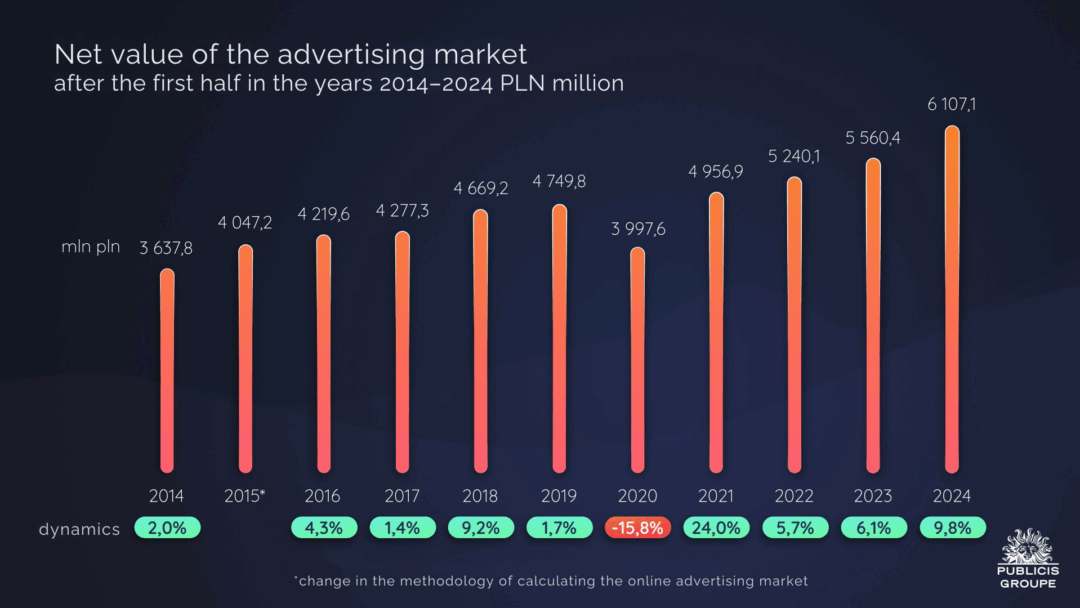

The estimated net value of the advertising market in Poland exceeded PLN 6.1 billion in the first half of 2024, marking a 9.8% year-over-year increase, according to the latest Advertising Market Report in Poland by Publicis Groupe.

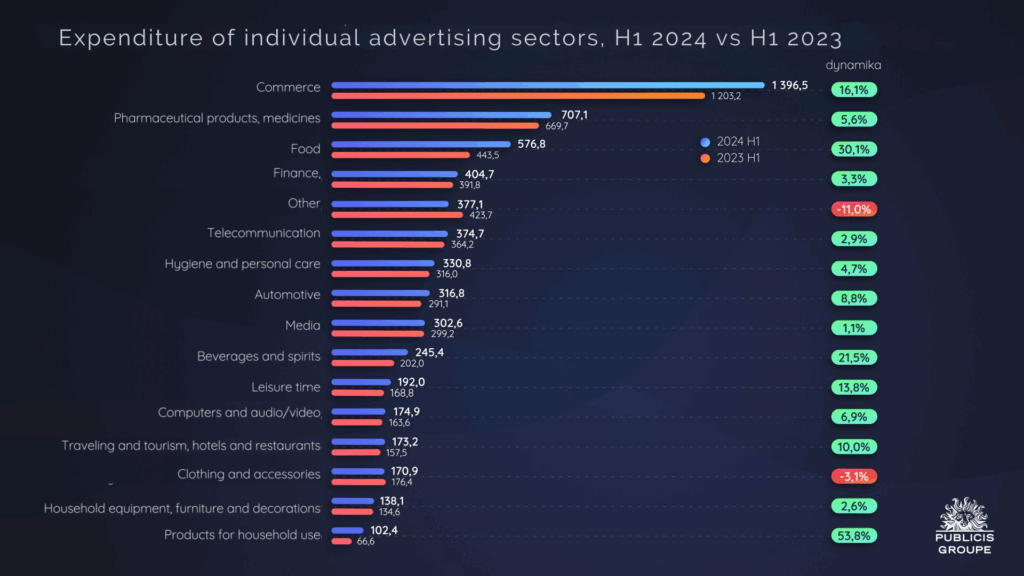

- Investments in video, internet, radio, out-of-home (OOH), and cinemas are growing, while press investments are declining.

- The fastest growth is seen in outdoor advertising, with an increase of nearly 24% year-over-year.

- Video now accounts for almost 54% of the advertising market.

- The share of the internet (digital search & digital non-search) stands at 30.8%.

- Outdoor advertising’s share increased from 5% to 5.6%.

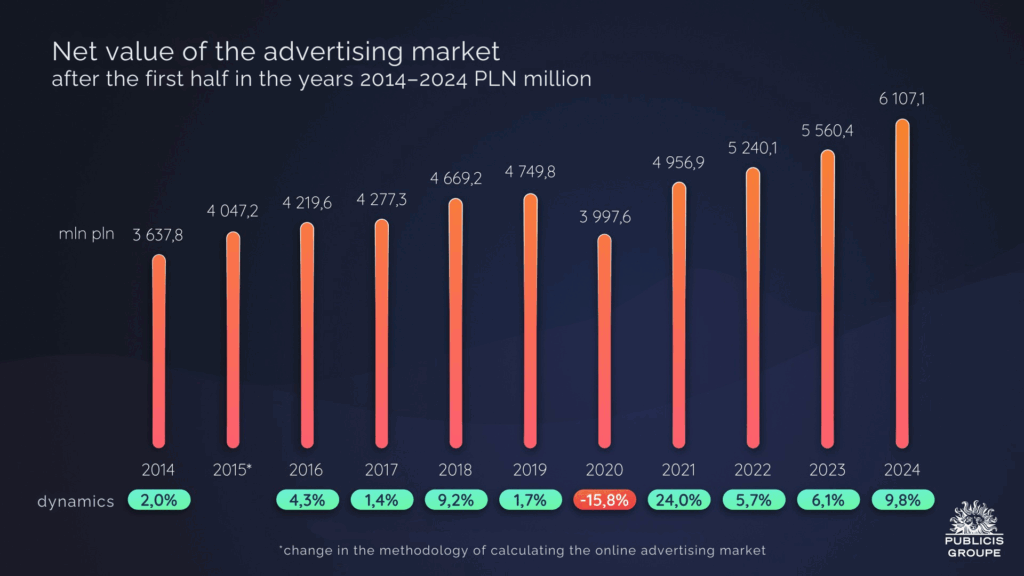

- The sector with the largest volume growth in advertising investments was retail.

Chart 1: Net advertising market value after the first half of the years 2014 – 2024

ADVERTISING SECTORS

In the first half of 2024, Poland’s advertising market grew by 9.8% compared to the same period in 2023. Fourteen sectors increased their advertising budgets, while only two reduced them. The retail sector generated the largest increase in spending volume, with companies in this sector allocating over PLN 193 million more to advertising, representing a 16.1% increase year-over-year. The leaders in spending within this sector are Lidl, Media Expert, and Jeronimo Martins. EURO 2024 significantly contributed to the growth in this sector. Retail remains the largest sector in the advertising market.

The largest decline in advertising investment volume occurred in the ‘others’ sector, with companies in this sector spending PLN 46.6 million less (a decline of 11%). Nearly half of this decline is attributed to reduced investments in the social advertising category. The leaders in spending within this sector are the European Union, Andreas Stihl (gardening, agriculture, livestock), and the Great Orchestra of Christmas Charity.

Chart 2: Expenditure of individual advertising sectors, H1 2024 vs H1 2023

COMMUNICATION CHANNELS

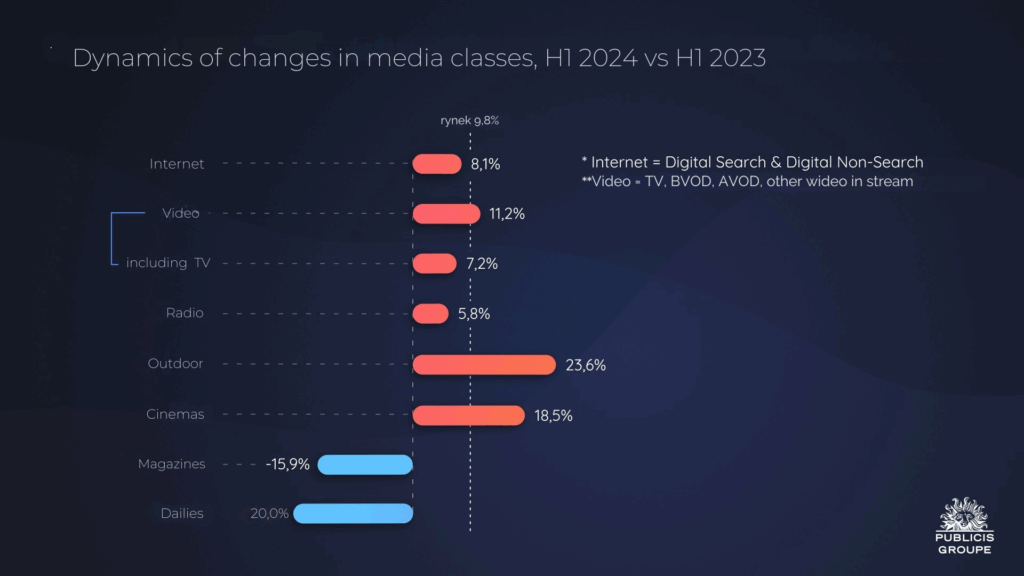

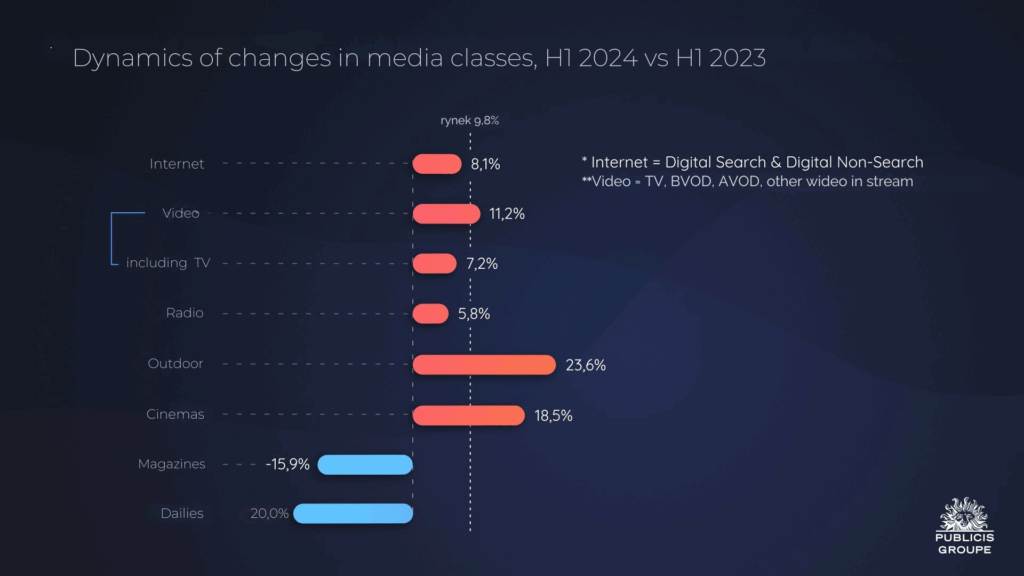

As a reminder, the previous edition of the Advertising Market Report introduced the ‘video’ category, encompassing both television and online video. In the first half of 2024, advertising investments increased in video, internet, radio, outdoor advertising, and cinema. However, expenditures in the press declined. The fastest double-digit growth was recorded in outdoor advertising, nearly 24%. Cinema advertising revenues grew slightly slower, by 18.5%. Video ranked third in growth rate at 11.2%, with television revenues alone growing by 7.2% and online video by nearly 23.2% from January to June 2024. Volume analysis shows that outdoor advertising secured stable revenue growth, increasing by PLN 65.6 million. Video budgets increased by PLN 328.2 million, internet by PLN 140.7 million, radio by PLN 23 million, and cinema by PLN 13 million. In the press, investment declined by a total of PLN 23 million.

Chart 3: Changes in advertising value by media classes, H1 2024 vs H1 2023

Chart 4: Dynamics of changes in media classes, H1 2024 vs H1 2023

According to Publicis Groupe’s analysis, the value of advertising investments allocated to video in the first half of 2024 amounted to PLN 3 billion 270.2 million, reflecting an 11.2% year-over-year growth. The share of video in advertising market revenues reached 53.6%, exceeding last year’s figure by 0.7 percentage points.

Among video segments, linear television continues to have the largest revenue share (72.7%). Advertising investments in this medium increased by 7.2% year-over-year in the first half of 2024, with spot advertising investments growing by 6.8%, indicating that sponsorship and product placement significantly contributed to the overall market dynamics during this period. The second video segment in terms of revenue share (25.9%) is other in-stream video, covering two components: video on social media platforms like YouTube, Meta, TikTok, and short-form videos on internet portals. Publicis Groupe’s revenue estimates for social video reflect YouTube’s dominance in viewership. The entire social media video segment (Facebook, YouTube, TikTok) grew by 27.3% in the first half, with updated estimates for TikTok’s revenues in 2023 and 2024. Meanwhile, revenue dynamics for short-form videos on internet services reached 18.6%, with the second quarter being notably better than the first, aided by the European Football Championship.

In the segment covering long-form video, broadcasters’ VOD revenues were 11% lower than last year, but the second quarter saw a significant improvement, with revenues in this segment matching last year’s figures for the same period. A 150% increase was noted in AVOD, or free advertising-supported services. These two aggregates are the most dynamic, experiencing numerous product changes. The decline in the BVOD segment in the first quarter was significantly influenced by changes in the product structure available within Player WBD TVN, related to the introduction of Max. In both products (Player and Max), users gain access to content in exchange for watching ads. The structuring of advertising products and viewer offerings explains the growth in the second quarter and indicates further development in the VOD segment.

None of the major platforms have yet decided to leverage the advertising potential of their SVOD (Subscriptions Video on Demand) services in the Polish market. Disney+ updated its pricing policy by introducing two packages: standard and premium, suggesting a focus on monetizing subscriptions (current users will be automatically assigned to the premium package).

Chart 5: Share of video forms in advertising revenues in H1 2024

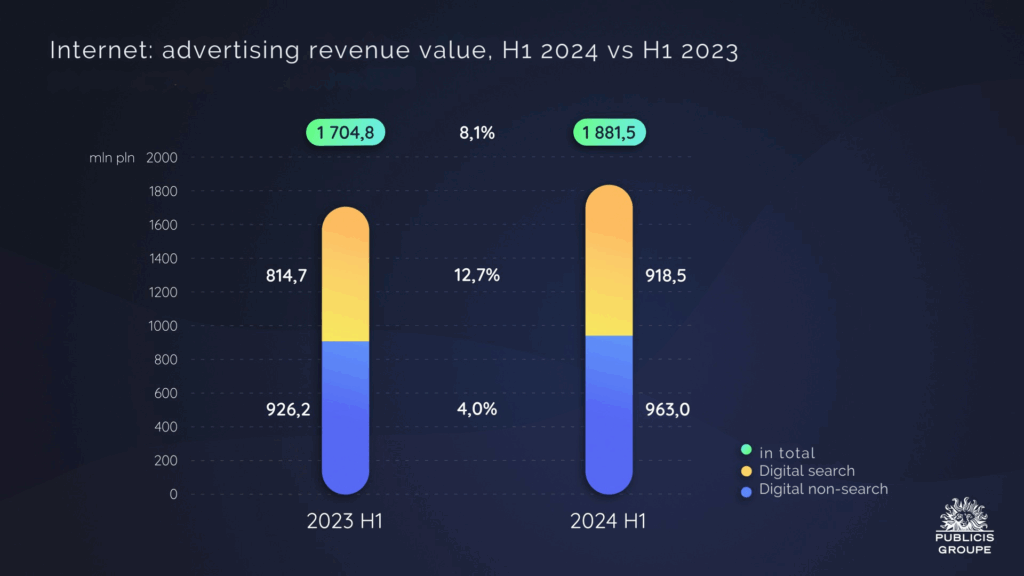

Publicis Groupe’s analysis indicates that the value of internet advertising investments in the new framework, excluding online video (not considering announcement expenditures), amounted to PLN 1,881.5 billion, reflecting an 8.1% year-over-year growth. The internet’s share in the advertising market in the first half of 2024 was 30.8% (a decrease of 0.5 percentage points).

Publicis Groupe estimates that revenues in the digital search segment grew by 12.7%. Currently, retail search accounts for 6% of revenues in the digital search segment in the Polish market, with the main share located in Google. However, this form of advertising shows promising dynamics, maintaining a growth rate of over 25%. Digital search is undergoing significant transformations. While users still predominantly use Google for most queries, the adoption of generative artificial intelligence will change the way users search for information, leading to the exploration of other search methods. Naturally, investments in paid search are shifting towards platforms like Amazon (strongly reflected in US market trends, source Jungle Scout) or Allegro, where shoppers in Poland, for example, begin their searches. (Sources: GWI; Consumer Journey Report by Minds&Roses for Allegro).

In the first half of 2024, digital non-search advertising grew by 4.0% year-over-year. Almost 92% of this online segment consists of display advertising, with Publicis Groupe experts estimating its dynamics at 3.9%. The growth driver for this digital non-search advertising remains display formats on META social networks.

Chart 6: Internet: advertising revenue value, H1 2024 vs H1 2023

Since the beginning of 2023, radio has consistently attracted substantial interest from advertisers, contributing to double-digit investment growth in each of the four consecutive quarters, from Q2 2023 to Q1 2024. Nevertheless, in Q2 2024, the rate of growth for radio advertising budgets noticeably slowed. In the first half of the year, the radio advertising market recorded a 5.8% increase, translating into a PLN 23 million rise compared to the same period last year. In the first half of 2024, the listenership of RMF Group, Time, and Polish Radio declined, while Eurozet Group, Audytorium 17, and other smaller stations saw increases. Despite a 0.8 percentage point decline in listenership share compared to the same quarter last year, RMF Group remains the undisputed leader in the radio market. Eurozet Group’s listenership share, however, increased by 1 percentage point, significantly strengthening its position. This result certainly influenced the main station, Radio ZET, whose share rose by 1.6 percentage points, marking the largest share increase among all radio stations during this period. (Data: Kantar). The largest volume increase in budgets was noted in the leading radio market sector, retail, which rose by nearly PLN 18 million (a 9.9% increase). The second place is occupied by the pharmaceuticals and drugs sector, with an increase of PLN 8.7 million (a 19.7% rise), while the automotive sector ranked third in terms of volume growth, raising its radio budget by PLN 6 million (an 18.3% increase).

From January to June 2024, investments in outdoor advertising were 23.6% higher than the previous year, amounting to PLN 65.6 million. Similar to the previous year, this growth was primarily driven by digital media. According to IGRZ and Publicis Groupe analyses, the share of digital media in advertising revenues increased from 24.3% in the first half of 2023 to 27% this year. In the first half of 2024, nine sectors increased their outdoor advertising budgets, while seven reduced them. The largest volume increase in advertising investments was recorded in the food sector, with an increase of over PLN 10.5 million (an 86.3% growth). The automotive sector stood out with exceptionally high dynamics (181.4%), with an increase of PLN 5.6 million compared to the previous year.

Publicis Groupe estimates that net advertising revenues in cinemas amounted to over PLN 83.3 million in the first half of 2024, representing an 18.5% increase over the previous year. Compared to 2019, the pre-pandemic period, the revenue level in the first half of 2024 is 27.2% higher. The top five sectors with the largest share of cinema advertising expenditures were media, finance, retail, automotive, and food. In terms of volume growth, the food sector stood out, increasing investments in cinema advertising by over PLN 4.3 million (a 132.1% growth), and the clothing and accessories sector, with a growth of PLN 3.4 million (a 319.2% increase). Interestingly, the two most active cinema sectors (media and finance) reduced their investments in this medium by a total of PLN 2.7 million. Meanwhile, the pharmaceutical sector returned to cinemas after a year of absence.

In the first half of 2024, investments in magazine advertising declined year-over-year by 15.9%, amounting to nearly PLN 13.4 million. The total number of advertising pages in magazines shrank by 12.2% (Source: Kantar). The sector with the largest volume decline was retail, which reduced its investments in catalog advertising by PLN 11.5 million (a 66.5% decline). The largest increase in spending was observed in the leisure sector, where companies allocated an additional PLN 0.5 million to advertising (a 33.6% growth).

Investments in newspaper advertising in the first half of 2024 fell year-over-year by 20.0%, or PLN 10.4 million. Eleven sectors contributed to the decline in daily press advertising spending, with the largest decrease occurring in the retail sector, which reduced its newspaper advertising investments by over PLN 4.7 million (a 64.7% decline). The second largest volume decline was in the ‘others’ sector (the largest sector advertising in newspapers, including business services, social advertising, foundations, political parties, real estate, and education, as well as heat plants, power plants, and others that significantly reduced spending in this medium), which saw a budget reduction of over PLN 3.5 million (a 16.5% decline). The largest volume increase was recorded in the finance sector’s advertising budgets, which grew by over PLN 0.5 million (a 15.0% increase).

MEDIA SHARES IN ADVERTISING REVENUES

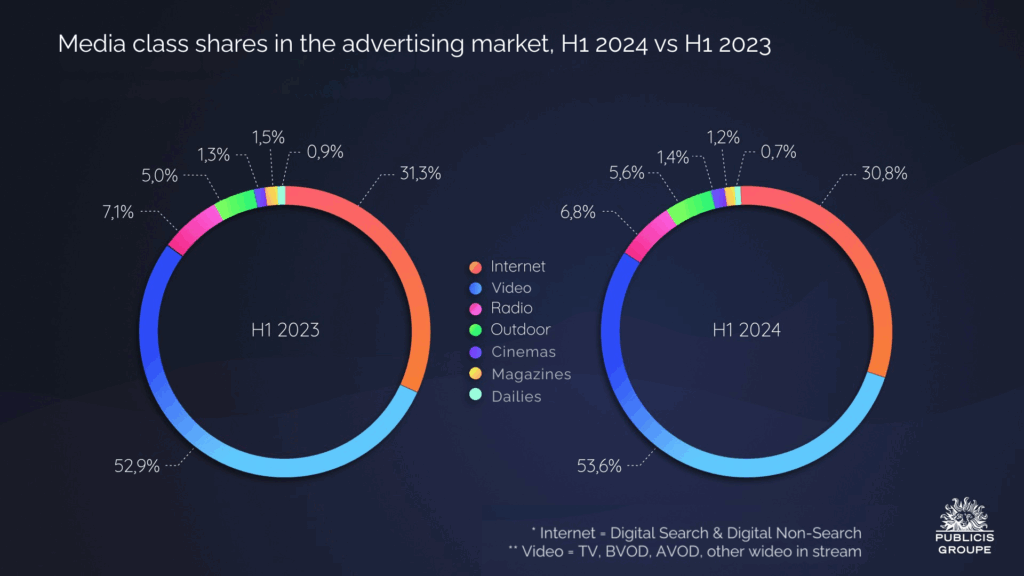

As a result of the varied dynamics of changes in different media classes, their market shares are also evolving. The shares of the internet (digital search and non-search) in the media mix decreased from 31.3% to 30.8%, while video (TV, BVOD, AVOD, other in-stream video) shares increased from 52.9% to 53.6%. Not only is the position of video growing, but outdoor advertising is also continuing to recover post-pandemic, with its share rising by 0.6 percentage points in the first half. Cinema is also experiencing growth after the crisis, though at a slower pace (+0.1 percentage points in share). Despite increased advertising revenues, radio’s share of the advertising pie decreased by 0.3 percentage points. The press also saw declines: for magazines from 1.5% to 1.2%, and for newspapers from 0.9% to 0.7%.

Chart 7: Media class shares in the advertising market, H1 2024 vs H1 2023

Commentary by Iwona Jaśkiewicz-Kundera, Chief Investment Officer at Publicis Groupe:

Once again, the Polish economy grew more than forecasted – GDP increased by 3.2% in the second quarter. The advertising market also exceeded forecasts and is growing much faster than the Polish economy, by 9.8% in the first half of 2024! Advertisers spent over PLN 6.1 billion on advertising.

From January to June 2024, advertising investments increased in all media except the press. The fastest growth was in outdoor advertising, over 20% year-over-year, and cinema, nearly 20%. Video advertising, which since the previous edition of the report includes both television and online video, grew by 11.2%. Internet advertising revenues increased by 8.1%. After the categorization change in the first quarter, the internet’s share stood at 30.8%, while video, the largest medium, accounted for 53.6%. The share of television alone was 38.9%, just 1 percentage point lower than last year. The market share of outdoor advertising significantly increased. In the first half of 2024, outdoor achieved a 5.6% share compared to 5% last year, with investments in outdoor advertising exceeding PLN 343 million. The rapid development of modern digital media, as well as the European Football Championship and the Olympic Games, prompted us to raise the growth forecast for this medium to 18.8% for the entire 2024. In the first half of 2024, the only budget declines occurred in the press. For newspapers, we recorded a 20% decline, mainly due to a halt in investments by public institutions and state-owned companies, while magazine advertising investments fell by over 15%, with the retail sector significantly reducing advertising budgets.

Fourteen sectors increased their advertising budgets, while only two reduced them. The retail sector generated the largest increase in spending volume, with companies in this sector allocating over PLN 193 million more to advertising, representing a 16.1% increase year-over-year. EURO 2024 significantly contributed to the growth in this sector. The largest decline in advertising investment volume occurred in the ‘others’ sector, with companies in this sector spending PLN 46.5 million less (a decline of 11%). Nearly half of this decline is attributed to reduced investments in the social advertising category.

The share of the largest sector in the advertising market, retail, increased by 1.3 percentage points to 23.3%. Since the fourth quarter of 2021, the second position has been occupied by the pharmaceuticals and drugs sector, which surpassed the food sector. However, the share of pharmaceuticals declined by 0.4 percentage points in the first half of 2024, standing at 11.8%. Meanwhile, the food sector’s share significantly increased, by 1.5 percentage points to 9.6%.

After the first half, we decided to raise the annual forecast for the internet, video (including TV), and outdoor. We estimate that the advertising market will grow by 8.8% in 2024.