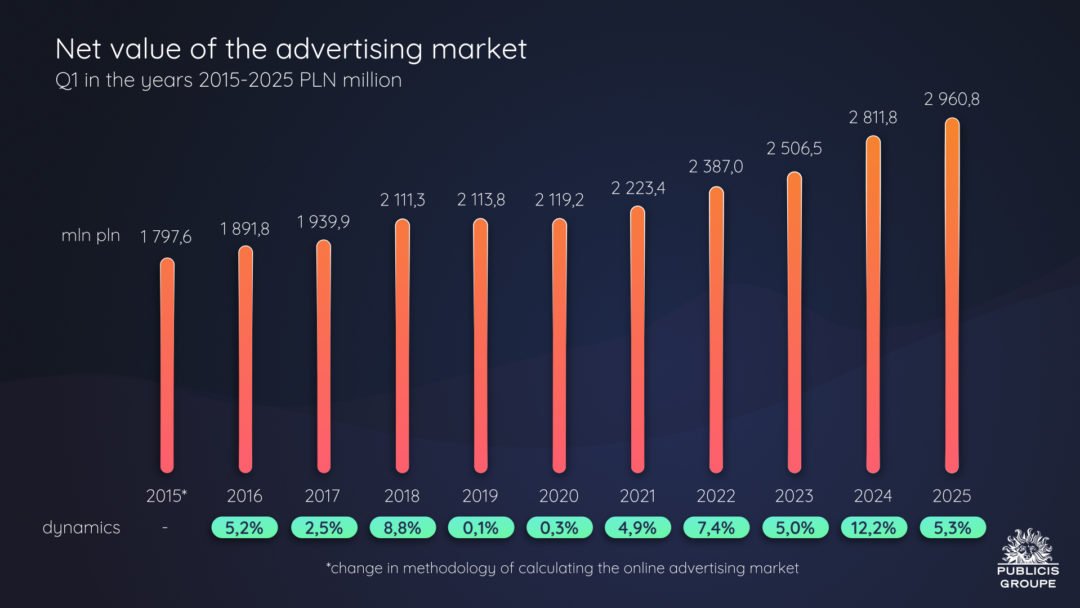

The estimated net value of the advertising market in Poland in the first quarter of 2025 was nearly PLN 3 billion, reflecting a year-over-year growth of 5.3%, according to the latest Advertising Market Report in Poland by Publicis Groupe Poland.

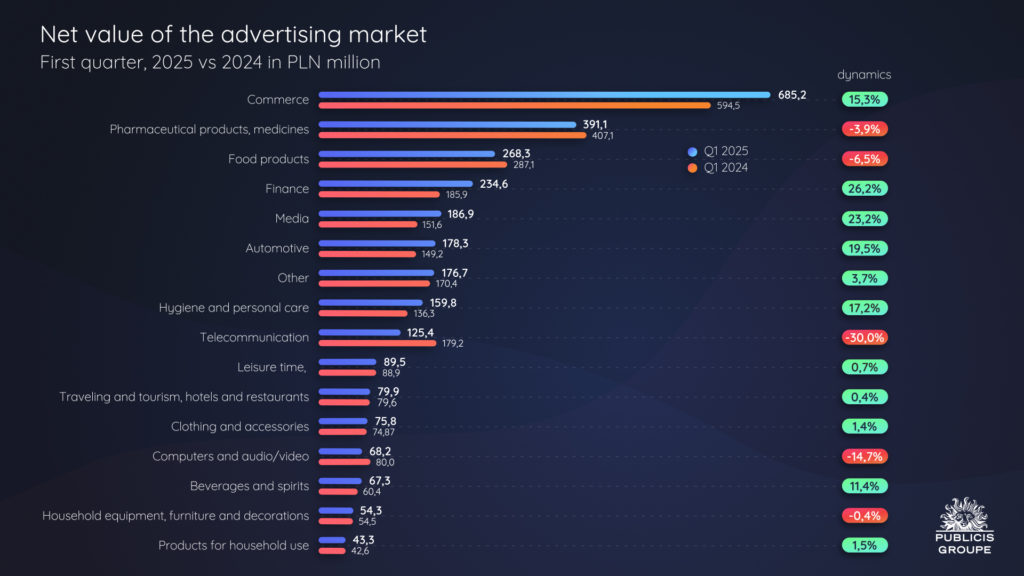

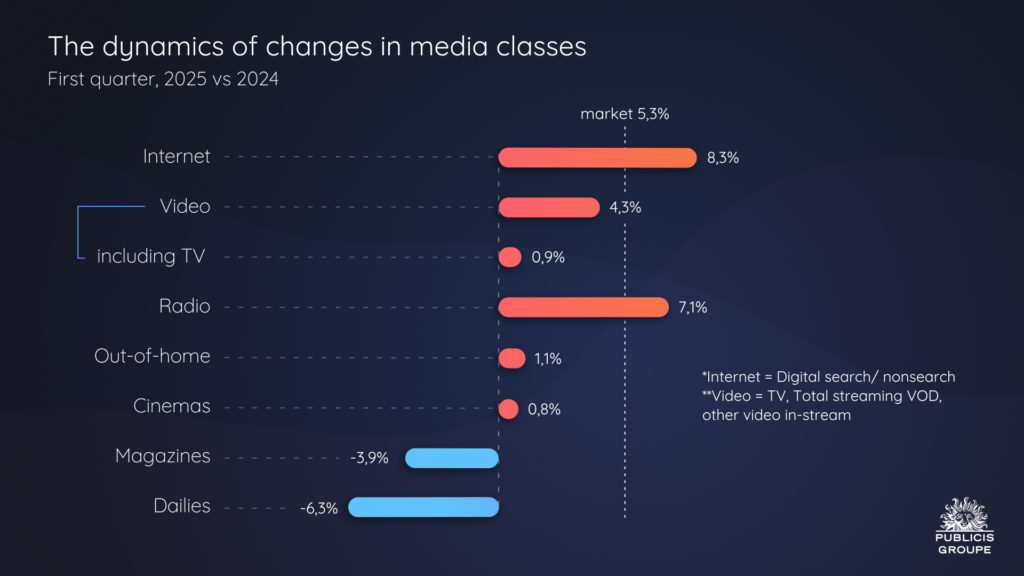

- Investments are increasing in internet, video, radio, out-of-home (OOH), and cinema, while decreasing in magazines.

- The internet is growing the fastest, with an 8.3% year-over-year increase.

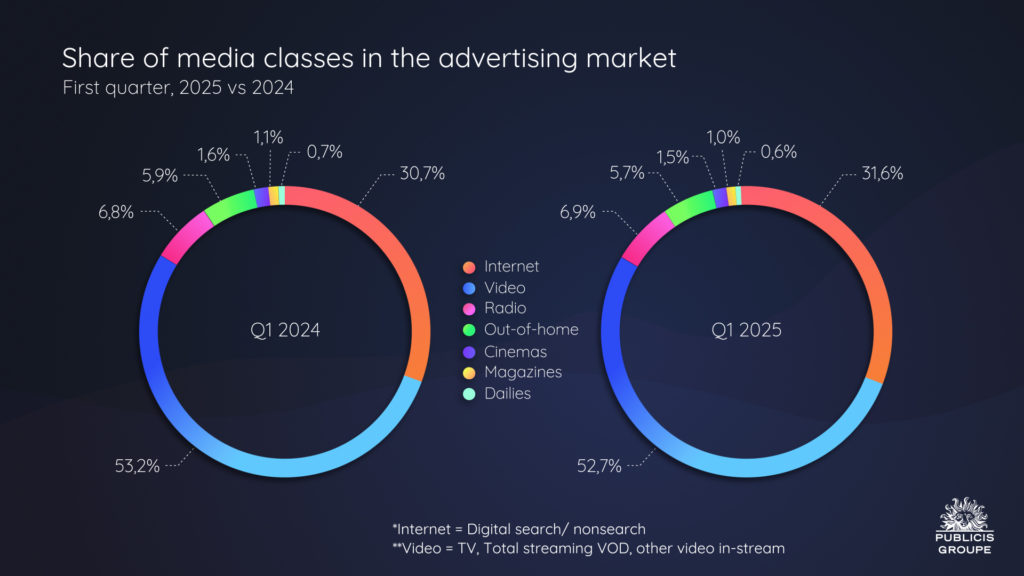

- Video holds a 52.7% share of the advertising market (a decrease of 0.5 percentage points).

- The internet’s share (digital search and digital non-search) is 31.6% (an increase of 0.9 percentage points).

- Radio sees a slight increase from 6.8% to 6.9%, while OOH drops from 5.9% to 5.7%.

- The sector with the largest volume growth in advertising investments is retail.

Graph 1. Net Advertising Market Value from 2015 to 2025

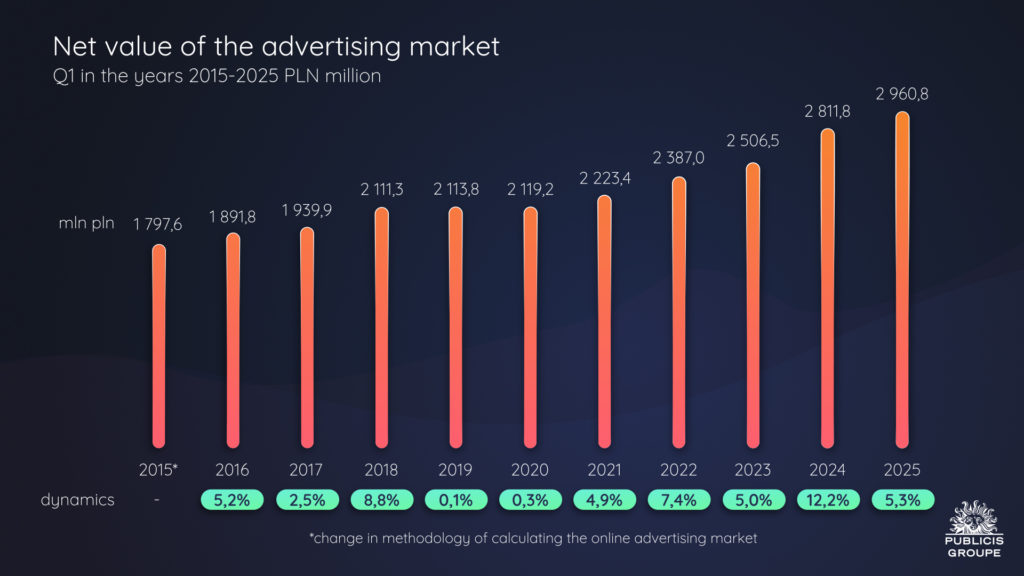

ADVERTISING SECTORS

In the first quarter of 2025, the Polish advertising market grew by 5.3% compared to the same period in 2024. Eleven sectors increased their advertising budgets, while five reduced their investments. The retail sector generated the largest volume growth in investments, with companies in this sector spending over PLN 90.5 million more on advertising, a 15.3% year-over-year increase. The leaders in this sector remain Media Expert, Lidl, and Jeronimo Martins. The telecommunications sector experienced the largest decline in investment volume, spending over PLN 53.8 million less on advertising, a 30.0% decline. Most top advertisers in this sector, such as Cyfrowy Polsat, Polkomtel, P4, and Orange, reduced their advertising investments.

Graph 2. Advertising Expenditures by Sector, 2025 vs. 2024

COMMUNICATION CHANNELS

From January to March 2025, advertising investments increased in internet, video, radio, out-of-home, and cinema, while expenditures on print decreased. Internet advertising grew the fastest, with a growth rate of 8.3%. Radio recorded the second-highest growth, also above the overall market growth. Video was the third fastest-growing category (+4.3%), with TV revenue growth at 0.9% and online video surpassing 13.6% in the first quarter of 2025. Revenue from external advertising grew by 1.1% and cinema by 0.8%. A volume analysis shows that internet budgets increased by PLN 71.7 million, video by PLN 63.8 million, and radio by PLN 13.5 million. Investments in print decreased by PLN 2.3 million.

Graph 3. Changes in Media Class Advertising Value, 2025 vs. 2024

Graph 4. Dynamics of Media Class Changes, 2025 vs. 2024

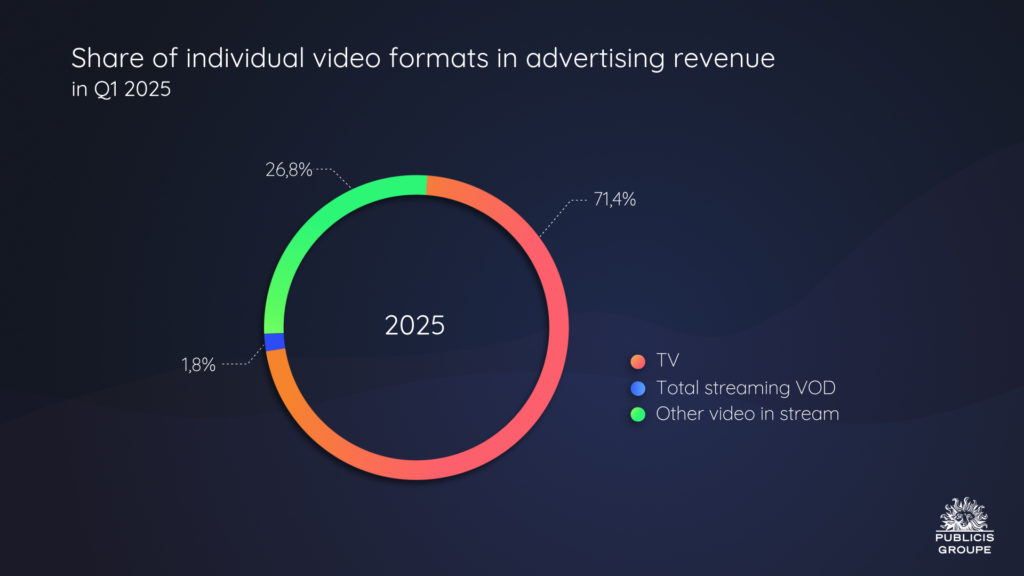

According to Publicis Groupe’s analysis, in the first quarter of 2025, video held the largest share of the advertising market at 52.7%, down 0.5 percentage points from the previous year. The value of advertising investments in video reached PLN 1.56 million, a 4.3% year-over-year increase. Within the video segments, linear TV still holds the largest revenue share (71.4%). Advertising investments in this medium grew by 0.9% year-over-year from January to March 2025. The second largest segment by revenue share (26.8%) is other in-stream video, which saw a growth rate exceeding 11.4%. This category includes two components: video on social platforms like YouTube, Meta, TikTok, and short-form videos on internet portals. Social platform video revenues grew by 12.5% in the first quarter of 2025, while short-form video revenues on internet portals rose by 7.2% in the same period.

In the video streaming segment (long-form videos on streaming portals, including BVOD, HVOD, and other VOD forms), Publicis Groupe analysts estimated a 77.8% increase in advertising investments. This high growth resulted from the previous year’s base, which didn’t include MAX or most FAST channels.

Graph 5. Share of Various Video Forms in Advertising Revenue in Q1 2025

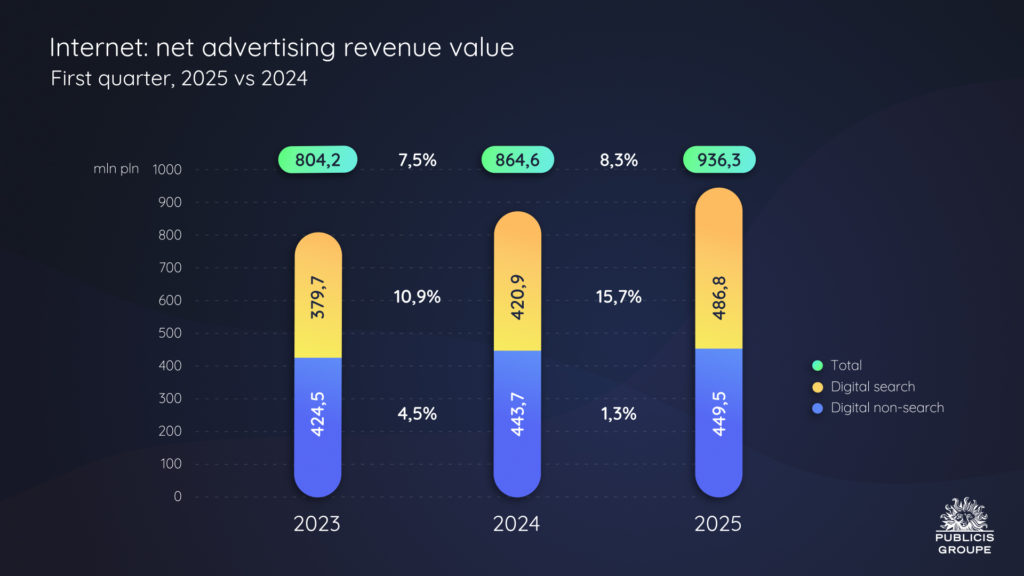

Publicis Groupe’s analysis indicates that in the first quarter of 2025, internet advertising investments (excluding classified ads) amounted to nearly PLN 940 million, marking an 8.3% year-over-year increase, making it the fastest-growing medium. The internet’s share of the advertising market during this period was 31.6% (0.9 percentage points more than in the first quarter of 2024).

Revenues in the digital search segment grew by 15.7% year-over-year in the initial months of 2025. In the Polish advertising market, the majority of digital search investments are placed in Google, with retail search accounting for about 7% of digital search revenues. However, the growth rate of this form of advertising is on an upward trend, reaching 26% from January to March 2025. Meanwhile, digital non-search advertising achieved a 1.3% year-over-year increase. A significant 91.4% of this online segment consists of display advertising, which was estimated to have a growth rate of 0.6%. Display formats on Meta’s social networks remain a growth driver for digital non-search advertising, although the growth rate of these investments slowed in the first quarter of 2025 compared to previous quarters.

Graph 6. Internet: Advertising Revenue Value, 2025 vs. 2024

According to Publicis Groupe analysts, the radio advertising market saw a growth rate above the overall market at 7.1% in the first quarter of 2025, increasing by PLN 13.5 million compared to the same period the previous year. In the first quarter of 2025, listenership declined for Eurozet Group, Polish Radio, and other smaller stations, while increases were noted for RMF Group, TIME, and Audytorium 17. RMF Group remains the unrivaled leader in the radio market, with a year-over-year increase in listenership of 1.5 percentage points. Eurozet Group’s listenership share fell by 1.2 percentage points. RMF FM, the main station of RMF Group, experienced a 0.9 percentage point increase in share, representing the largest growth among all radio stations during this period. TIME Group ranked third, with its listenership share rising by 0.3 percentage points. (Source: Kantar)

In the first quarter of 2025, investments in out-of-home advertising were 1.1% higher than the previous year, amounting to PLN 1.9 million (in collaboration with OOHLife, we updated our 2024 estimates due to an expanded company base). As in the previous year, this growth was primarily generated by digital displays. Analyses from the OOHlife Chamber of Commerce and Publicis Groupe indicate that the share of digital displays in advertising revenues increased from 25.6% in Q1 2024 to 30.3% in 2025. The media sector recorded the largest volume growth in advertising investments, nearly PLN 4.8 million (48.3% growth), largely driven by campaigns from Telewizja Polska and Antyradio. Conversely, the telecommunications sector saw the largest decline in spending (down PLN 7.9 million, partly due to the absence of a major Plus campaign) and retail (down PLN 2.1 million, partly due to reduced spending by Biedronka and Castorama).

Net cinema advertising revenues from January to March 2025 were nearly PLN 45 million, representing a 0.8% year-over-year increase. The top five sectors with the largest share of cinema advertising expenditures included media, automotive, food, retail, and travel, tourism, hotels, and restaurants. The automotive sector stood out in terms of volume growth, increasing cinema advertising investments by over PLN 4 million (132.1% growth). Meanwhile, the finance sector saw the largest decline in cinema advertising budgets, reducing spending by PLN 4.6 million (62.8% decline).

In the first quarter of 2025, investments in advertising in glossy magazines declined year-over-year by 3.9%, or nearly PLN 1.2 million. The total number of advertising pages in magazines shrank by 24.2%. (Source: Kantar). The sector with the largest volume decline was “other” (down PLN 0.7 million, an 18.5% decline), particularly in investments by foundations, associations, and public institutions. The media sector saw the largest growth in expenditures, with companies in this sector spending PLN 0.7 million more (38.8% growth). Investments in daily press advertising fell year-over-year by 6.3% in the first quarter of 2025, a decline of PLN 1.15 million, totaling PLN 17.2 million. The largest decline occurred in the travel, tourism, hotels, and restaurants sector, which reduced its advertising investments in dailies by over PLN 0.9 million (41.4% decline). Publicis Groupe analysts noted the largest volume growth in media sector advertising budgets, up PLN 0.5 million (50.6% growth).

SHARE OF MEDIA IN ADVERTISING REVENUE

Due to the varied growth dynamics of different media classes, their market share is also changing. The share of video (TV, streaming VOD, and other in-stream video) decreased from 53.2% to 52.7%, while the internet’s share (digital search and non-search) in the media mix increased by nearly 1 percentage point to 31.6%. Together, video and internet account for 84.3% of the entire advertising market. The radio advertising share also increased by 0.1 percentage points to 6.9%. Meanwhile, the share of other media in the media mix decreased: out-of-home advertising fell by 0.2 percentage points to 5.7%, and cinema, magazines, and dailies decreased by 0.1 percentage points each to 1.5%, 1%, and 0.6%, respectively.

Graph 7. Share of Media Classes in the Advertising Market, 2024 vs. 2023

Commentary by Iwona Jaśkiewicz-Kundera, Chief Investment Officer of Publicis Groupe Poland:

The advertising market began 2025 with stable growth at 5.3%, indicating the healthy state of our industry. We hope this result reassures advertisers and broadcasters concerned about news from the USA regarding trade policies that could destabilize the global economy. Currently, uncertainty remains the primary threat to business development and complicates effective forecasting. However, forecasts for the Polish economy in 2025 are optimistic, and we predict an advertising market growth of 8.2%.

In the first quarter of 2025, advertising investments increased in all media except print. Internet advertising grew the fastest, at 8.3% year-over-year (with search category growing the most dynamically). Radio saw slightly slower growth, at over 7%. Other media achieved growth rates below the market average: video advertising investments increased by 4.3%, out-of-home advertising by 1.1%, and cinema expenditures by 0.8%. Print media experienced declines: magazines by 3.9% and print newspapers by 6.3%.

The structure of the advertising pie underwent slight changes – the internet’s share rose in the first quarter of 2025 from 30.7% to 31.6%, while video’s share slightly declined from 53.2% to 52.7%. Together, video and internet account for 84.3% of the entire advertising market. Radio strengthened its position, mainly due to intensive automotive sector advertising campaigns in the first quarter. Out-of-home advertising, lacking the driving force of investments from the “other” sector (particularly foundations, associations, and political institutions), decreased in share from 5.9% to 5.7%, but still remains a significant part of the media mix alongside radio.

Eleven sectors increased advertising budgets, while five reduced them. The retail sector recorded the largest growth in expenditure volume, with companies investing PLN 90.5 million more in advertising, a 15.2% year-over-year increase. The telecommunications sector saw the largest decline in advertising investments, with companies in this sector spending PLN 53.8 million less on advertising (a 30.0% decline). Most key advertisers in this sector, including Cyfrowy Polsat, Polkomtel, P4, and Orange, reduced their advertising budgets.

The largest sector in the advertising market, retail, saw its share increase by 2.1 percentage points to 23.8%. Since the fourth quarter of 2021, the pharmaceutical and drug sector has held the second position, surpassing the food sector. However, the pharmaceutical share decreased by 1.2 percentage points to 13.6% during the analyzed period. The food sector’s share also declined by 1.2 percentage points to 9.3%.