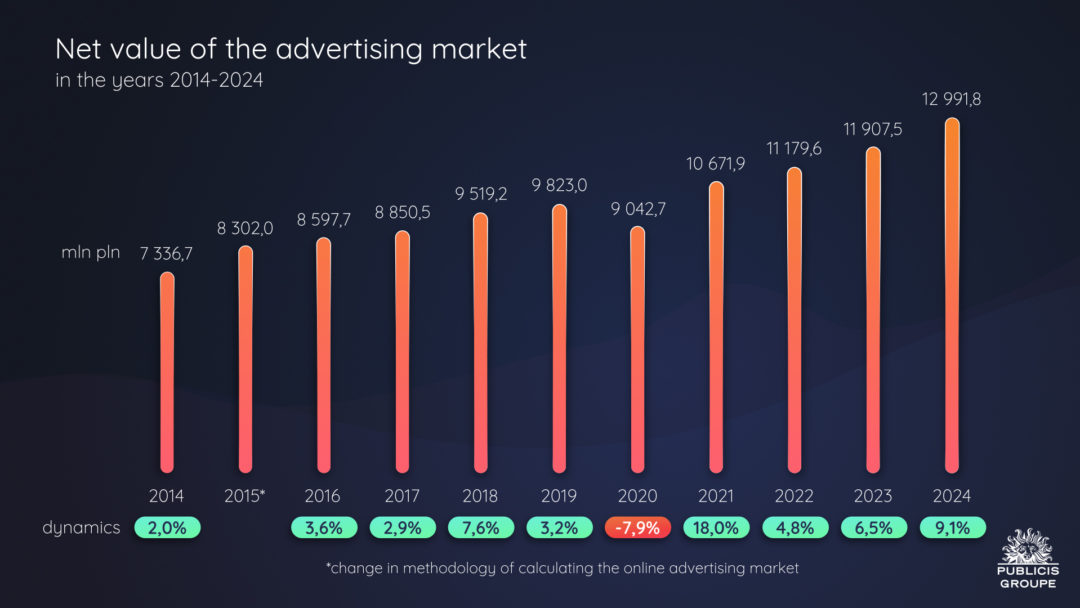

The estimated net value of the advertising market in Poland in 2024 amounted to nearly PLN 13 billion, an increase of 9.1% year-on-year, according to the latest Report on the Advertising Market in Poland, created by Publicis Groupe.

- Investments in video, Internet, radio, OOH and cinemas are increasing, while they are decreasing in the press

- Cinema advertising is growing the fastest, by over 12% year-on-year

- The share of video in the advertising market is 54.3% (up by 0.9 p.p.)

- The Internet’s share (digital search & digital non-search) is just under 30%

- The share of outdoor advertising increased from 5.4% to 5.5%

- The sector with the highest volume of advertising investment is commerce

Chart 1. Net value of the advertising market in the years 2014-2024

ADVERTISING SECTORS

In 2024, the advertising market in Poland increased in value by 9.1% compared to 2023. Ten sectors increased advertising budgets, while six reduced them.

The commerce sector generated the highest increase in expenditure volume – companies from this sector spent nearly PLN 539 million more on advertising, representing a 20.2% increase year-on-year. A big influence on the increases in this sector was the activity of EURO 2024 advertisers.

In contrast, the only decrease in the volume of advertising investment took place in the other sector. Manufacturers and institutions in this sector spent over PLN 161 million less on advertising ((a growth rate of -16.0%). Reduced investment in the social advertising category is responsible for more than half of this decline.

Chart 2. Expenditure of individual advertising sectors, 2024 vs 2023

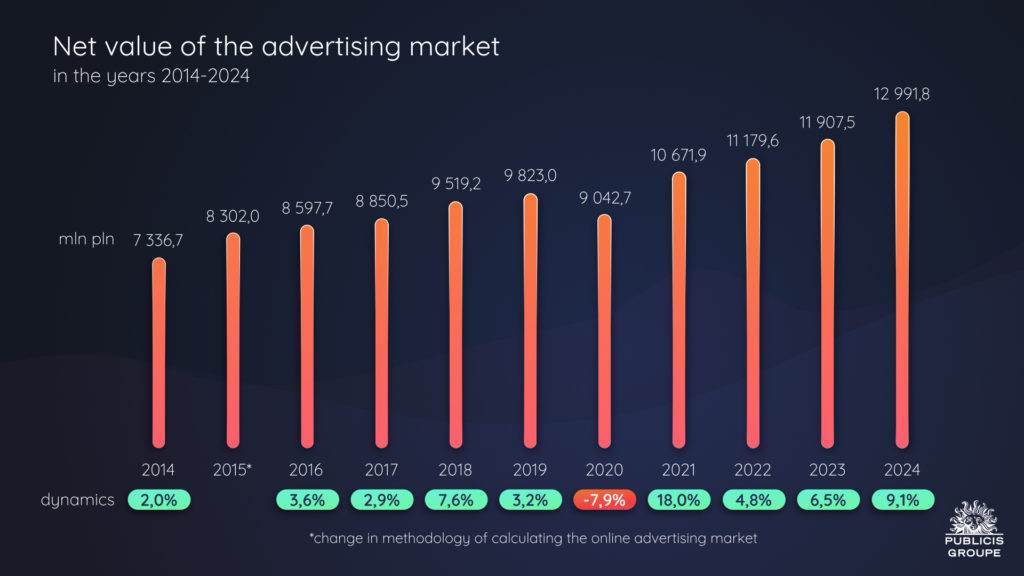

COMMUNICATION CHANNELS

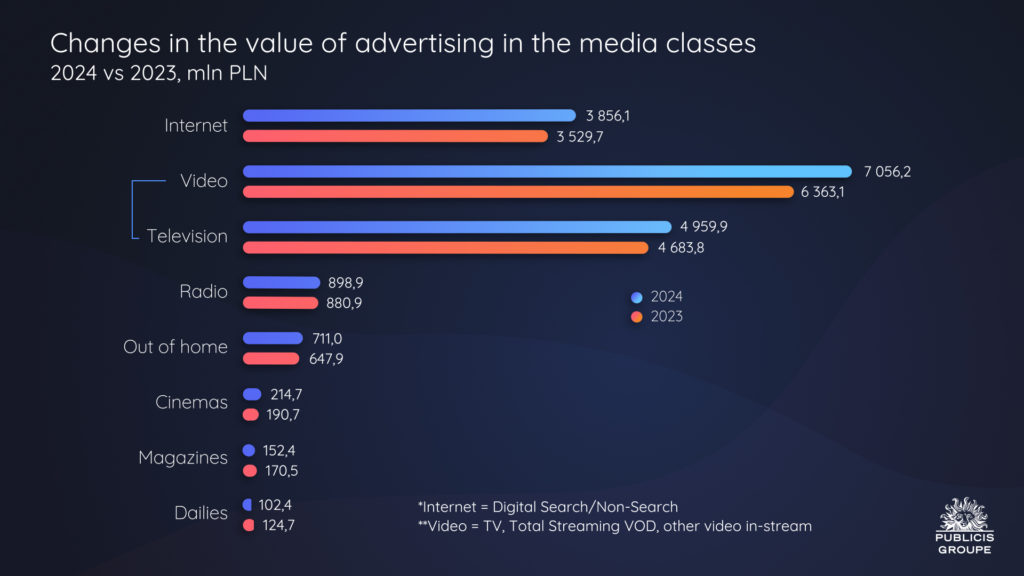

In 2024, advertising spending on the Internet, radio, outdoor advertising and cinema increased. Expenditures on press decreased. The fastest double-digit growth was recorded for cinema advertising – almost 12.6%. The second fastest growing was video (10.9%), with a revenue growth of 5.9% for TV alone and over 24.8% for online video between January and December 2024. Outdoor advertising revenue grew at a slightly slower rate of 9.7%. The volume analysis shows that video budgets increased by PLN 683.2 million, Internet by PLN 326.4, outdoor by PLN 63.2 million, cinema by PLN 24 million and radio by 18.1 million. In the press, the decrease in investment amounted to PLN 40.4 million.

Chart 3. Changes in advertising value in media classes, 2024 vs 2023

Chart 4. The dynamics of changes in media classes, 2024 vs 2023

Publicis Groupe analysis shows that video had the largest share of the advertising market in 2024. The share was 54.3%, exceeding last year’s by 0.9pc. The value of advertising investment allocated to video amounted to 7,056.8 million, an increase of 10.9% year-on-year.

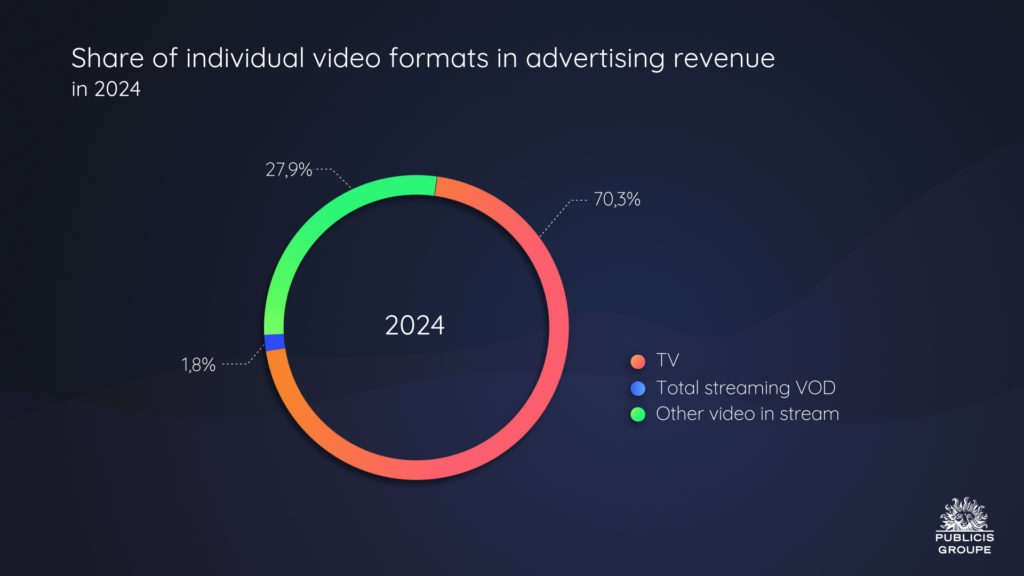

Among the video segments, linear TV consistently has the largest revenue share (70.3%). Advertising investment in this medium increased by 5.9% year-on-year in 2024. The second video segment in terms of revenue share (27.9%) is other in-stream video, comprising two components: video on the social media platforms YouTube, Meta, Tiktok and short-form video on online portals. The video segment on social networks grew by 28.6% in 2024 (TikTok’s previous revenue estimates for 2023 and 2024 have been updated). On the other hand, the dynamics of revenues from short-form video on web portals amounted to 14.2%, with the best quarter being Q2 due to the European Football Championship being played at the time.

In the segment comprising long-form video (streaming video in the form of both BVOD, AVOD and SVOD), Publicis Groupe analysts have forecasted an increase in advertising investment of 16.8%. This high result was determined by the autumn and the wide range of films and series offered on VOD platforms.

Chart 5. Share of individual video forms in advertising revenue in 2024

According to Publicis Groupe’s analysis, in 2024, the value of online advertising investment in a new perspective, i.e. excluding online video (not including ad spending), amounted to PLN 3,856 billion, up 9.2% year-on-year. The Internet’s share of the advertising market in the period was 29.7% (0.1 p.p. higher than in 2023).

Publicis Groupe estimates that digital search revenues had grown by 13.8% year-on-year in 2024. On the Polish advertising market, the main part of investment in digital search is located in Google, while retail search is responsible for slightly around 7% of revenues in the digital search segment. However, the dynamics of this form of advertising are on an upward trend, reaching 29% in 2024.

In 2024, digital non-search advertising achieved 5.2% growth, year-on-year. As much as 92% of this online segment is made up of display advertising, the dynamics of which we estimated at 4.8%. Display formats on Meta’s social networks remain the growth driver for digital non-search advertising, but in Q4, revenues from this form of advertising also increased on the portals of Polish publishers.

Chart 6. Internet: value of advertising revenues, 2024 vs 2023

According to Publicis Groupe analysts, the market for radio advertising in 2024 recorded a growth of 2%, meaning an increase of PLN 18 million in value compared to the previous year. With a noticeable slowdown in Q2 and Q3 2024, the rate of growth in radio advertising budgets slowed down, and in Q4 there was a two per cent reduction in investment compared to the previous year. In 2024, the listenership of RMF Group, Polskie Radio and Time Group declined, while increases occurred for Eurozet Group, Audytorium 17 and other smaller radio stations. Despite a year-on-year drop in audience share (-0.5 p.p.), RMF Group remains the unmatched radio market leader. Eurozet Group’s audience share increased by 0.3 p.p. and the broadcaster is strengthening its position. This result was undoubtedly influenced by the main station, Radio ZET, whose share increased by as much as 1.3 p.p., the largest increase among all radio stations in this period. In third place was TIME Group, whose listenership share fell by 0.1 p.p. (Source: Kantar)

In 2024, advertising investment in outdoor advertising was 9.7% higher than the previous year, or PLN 63.2 million. As during the last year, this growth was generated primarily on digital media. Analyses by the OOHlife Chamber of Commerce and Publicis Groupe show that the share of digital media in advertising revenues increased from 24.7% in 2023 to 29.8% in 2024. Publicis Groupe analysts recorded the largest volume increase in advertising investment for the beverages and spirits sector – by more than PLN 14.1 million (a growth rate of 54.4%). On the other hand, the largest decrease in the volume of expenditure was in the other sector (down by PLN 19.8 million, with a particular decline in social advertising, municipal services and foundations, associations, and political institutions) and commerce (down by PLN 8.6 million).

Publicis Groupe estimates that net advertising revenues in cinemas will amount to nearly PLN 214.7 million in 2024, representing 12.6% year-on-year growth. The top 5 sectors with the largest share of cinema advertising spending were media, automotive, food, commerce and finance. The telecommunications sector stood out in terms of growth volume, increasing its investment in cinema advertising by almost PLN 7.8 million ((a growth rate of 106%). In contrast, the largest drop in the volume of cinema advertising budgets was recorded in the finance sector, with advertisers in this sector reducing expenditures by PLN 4.5 million ((a growth rate of – 17.1%).

Throughout 2024, investment in advertising in magazines fell year-on-year by 10.6%, i.e. by almost PLN 18.1 million. The total number of advertising pages in magazines shrank by 12.4%(Source: Kantar). The sector with the largest volume decrease is the commerce sector (down by PLN 13.9 million, with a growth rate of -55%), which has particularly reduced mail-order advertising communications in magazines. The biggest increase in spending could be observed in the clothing and accessories sector. Companies in this sector spent PLN 2.8 million more on advertising (a growth rate of 11.7%).

In 2024, investments for advertising in the daily press decreased year-on-year by 17.9%, i.e. by PLN 22.3 million. The highest decline was in the “other” sector, which is the largest sector advertising in dailies, including business services, social advertising, foundations, political parties, real estate and education, and heating plants, power plants, others. The sector reduced its advertising investment in dailies by almost PLN 10.9 million (a growth rate of -20.3%). The largest volume increase was recorded in the case of advertising budgets for the telecommunications sector – by PLN 0.6 million (a growth rate of 34.6%).

MEDIA’S SHARE OF ADVERTISING REVENUE

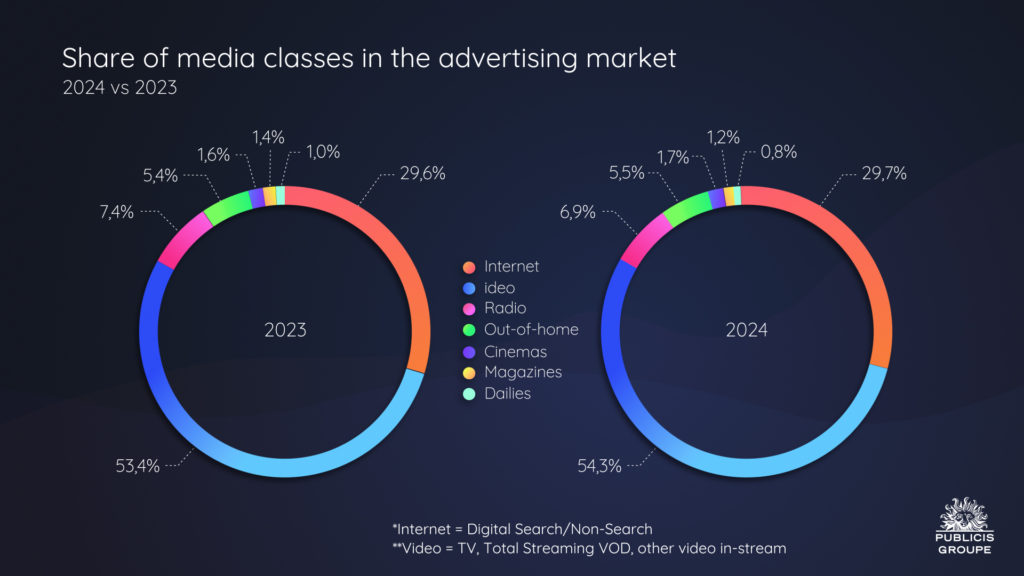

As a consequence of the varying dynamics of change of the different media classes, their market share is also changing. The share of video (TV, VOD streaming and other in-stream video) increased from 53.4% to 54.3%, while the share of Internet (digital search and non-search) in the media mix increased marginally by 0.1 p.p. to 29.7%. For outdoor and cinema advertising, the share also increased by 0.1 p.p. to 5.5% and 1.7%, respectively. In contrast, after a weaker Q4, the share of radio advertising fell by as much as 0.5 p.p., from 7.4% to 6.9%. We also saw a decline in the advertising market share of the press: the share of magazines decreased from 1.4% to 1.2%, and of dailies from 1.0% to 0.8%.

Chart 7. Share of media classes in the advertising market, 2024 vs. 2023

Comment by Iwona Jaśkiewicz-Kundera, Chief Investment Officer Publicis Groupe:

According to a preliminary estimate by Statistics Poland, in 2024, the Polish economy expanded by 2.9% year-on-year, compared to a growth of 0.1% in 2023. Household consumption grew by 3.1%. Preliminary figures from Statistics Poland for Q4 show that GDP grew by 3.2% year-on-year in real terms, compared to a growth of 1.0% in the corresponding period of 2023. The advertising market, in turn, grew at an impressive rate of 9.1%, reaching a value of nearly PLN 13 billion. In Q4 alone, the advertising market growth rate was 8.4 per cent.

In 2024, advertising investment in all media except the press increased. The fastest growth was in cinema advertising, which increased by 12.6% y-o-y, video was slightly slower – by nearly 11% and out-of-home advertising by 9.7%. Online advertising revenues also grew above market dynamics, up 9.2%. Following the change in categorisation at the beginning of 2024, the share of the Internet was 29.7% in 2024, while video was the largest medium, with a share of 54.3% compared to 53.4% in 2023, while TV alone had a share of 38.2%, down 1.2% from 2023. On the other hand, outdoor advertising recorded an increase in market share, reaching 5.5% (up 0.1 %) and cinema 1.7%. Advertising investment in radio increased by 2.0% in 2024. In particular, the second half of the year was not successful for radio advertising, partly the result of a high base in the second half of 2023, when public entities and state-owned companies were highly active in radio. Radio’s advertising market share decreased to 6.9% in 2024 from 7.4% in 2023. The decline in the activity of public institutions is also linked to the drop in advertising budgets in the daily press. In the case of dailies, we recorded a 17.9% decrease. Advertising investment in magazines declined by 10.6%, and advertising budgets were heavily reduced by the commerce sector while advertising investment in other media increased.

As many as fifteen sectors increased their advertising investment and only one made a reduction. The commerce sector generated the highest increase in expenditure volume – companies from this sector spent nearly PLN 539 million more on advertising, representing a 20.2% increase year-on-year. The EURO 2024 championships greatly impacted the increases in this sector. On the other hand, the only decrease in the volume of advertising investments took place in the other sector – by over PLN 161 million (a growth rate of -16.0%). Reduced investment in the social advertising category is responsible for more than half of this decline. The share of the largest sector in the advertising market, commerce, increased by 2.4 p.p. to 25.2%. As of Q4 2021, second place is held by the pharmaceutical products and medicines sector, which has overtaken the food sector. Pharmacy’s share, however, fell by 0.8 p.p. to 10.4% in the analysed period. In contrast, the share of the food sector increased by 0.7 p.p. and stood at 9.2%.