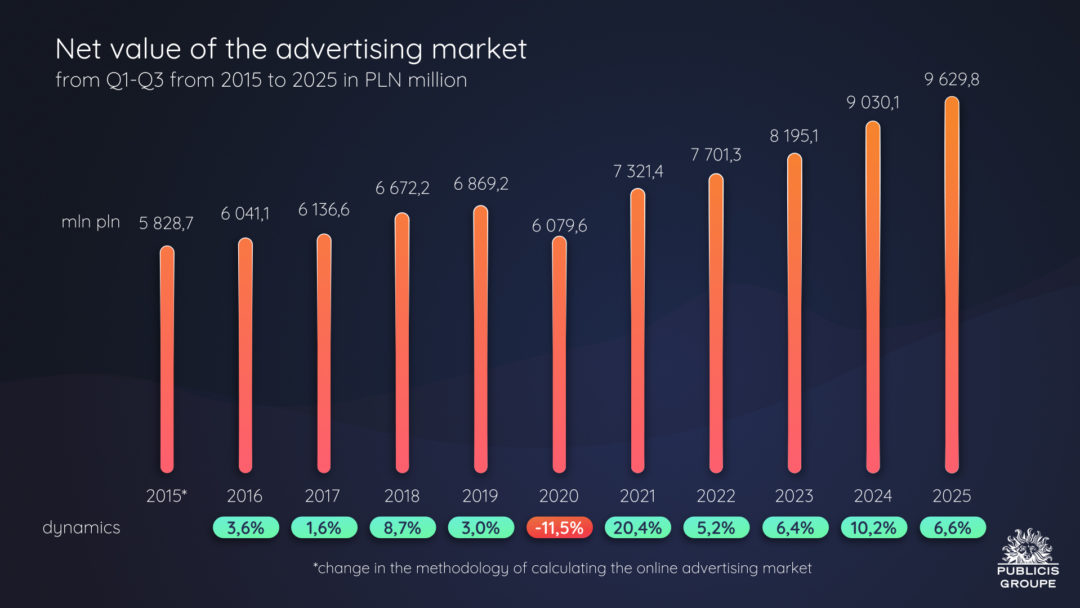

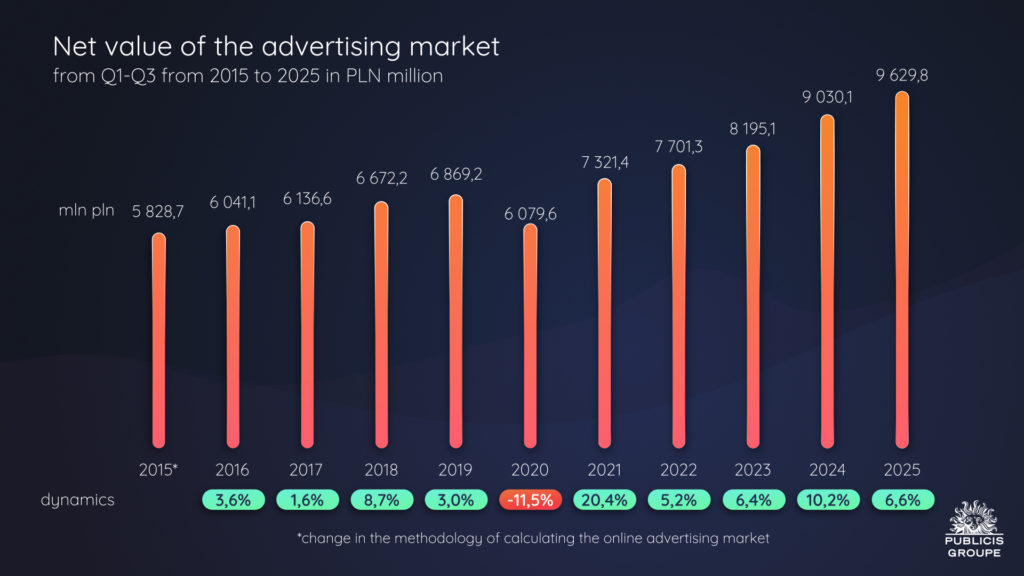

The estimated net value of the advertising market in Poland after three quarters of 2025 amounted to over PLN 9.6 billion, an increase of 6.6% year-on-year, according to the latest Report on the Advertising Market in Poland, created by Publicis Groupe Poland.

- Investments in the Internet, video, radio, OOH, newspapers and cinemas are increasing, while they are decreasing in magazines

- Online video is growing the fastest, by 19% year-on-year

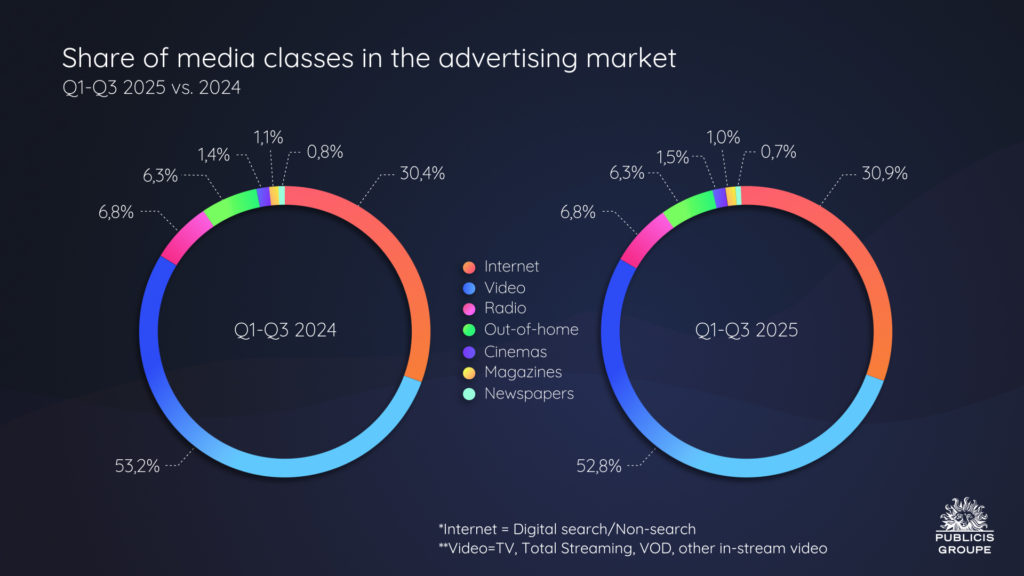

- The share of video in the advertising market is 52.8% (a 0.4 p.p. decrease).

- The Internet’s share (digital search & digital non-search) is 30.9% (up by 0.5 p.p.).

- The sector with the highest advertising investment volume is commerce.

Chart 1. Net value of the advertising market in the years 2015-2025

ADVERTISING SECTORS

According to analysts at Publicis Groupe, the advertising market in Poland declined by 6.6% year-on-year after three quarters of 2025. As many as 13 sectors increased advertising budgets, while three made reductions.

The largest increase in investment volume was in commerce. Companies in this sector spent PLN 267.3 million more, representing a 12.7% year-on-year increase. Leaders in this sector are: Media Expert, Lidl and Kaufland.

The most significant decrease in advertising investment volume occurred in the telecommunications sector. Companies in this sector spent PLN 82.1 million less on advertising (a decrease of -15.2%). The following companies have reduced their advertising budgets significantly: Cyfrowy Polsat, Orange Polska and P4, Internet and television investments in this sector have decreased significantly, as have out-of-home expenditures.

Chart 2. Expenditure of individual advertising sectors, 2025 vs 2024

COMMUNICATION CHANNELS

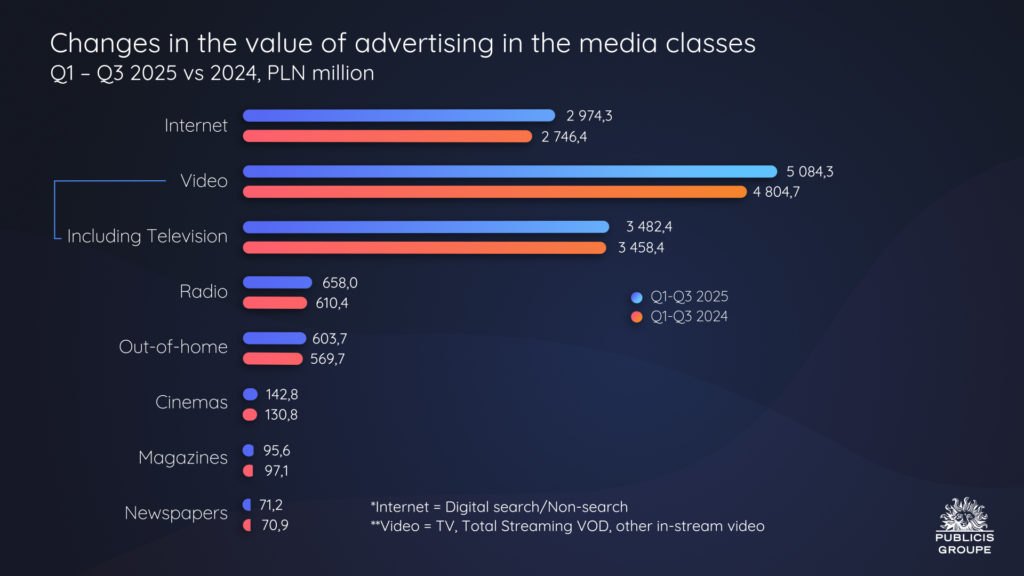

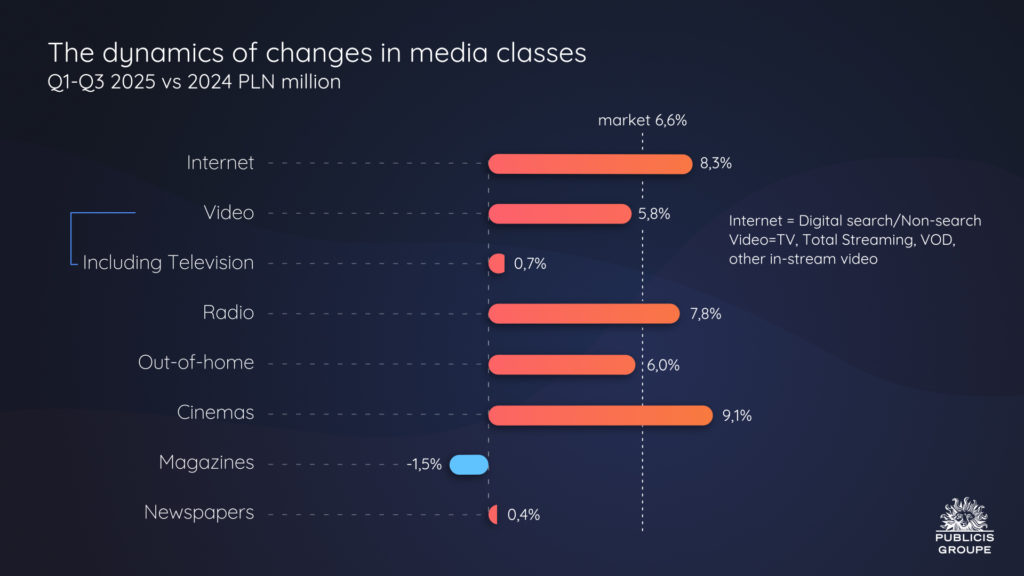

Publicis Groupe estimates show that from January to September 2025, advertising investments in video, the Internet, radio, outdoor advertising, cinema and newspapers have increased. Similarly to H1, investments in magazine advertising have declined. The fastest growth was recorded in cinema advertising, up 9.1%. The second-highest growth, also higher than the market as a whole, was recorded in internet advertising, where investments increased by 8.3%. The third medium in terms of growth was radio, with advertising investment dynamics of 7.8%. The video market grew by 5.8%, with TV-only revenue growth slowing to 0.7% and online video growth at 19.0% for the period January to September 2025. Outdoor advertising revenues grew by 6.0% after three quarters and newspapers by 0.4%. However, advertising revenues in magazines decreased by 1.5%. The volume analysis shows that video budgets increased by nearly PLN 280 million, while investment in online advertising increased by just under PLN 228 million and radio by PLN 47.6 million. In magazines, the decrease in investment amounted to close to PLN 1.5 million.

Chart 3. Changes in advertising value in media classes, 2025 vs 2024

Chart 4. The dynamics of changes in media classes, 2025 vs 2024

Publicis Groupe’s analysis shows that after the first three quarters of 2025 video had the largest share of the advertising market at 52.8%, compared to 53.2% in the same period last year. The value of advertising investment allocated to video was close to 5.1 billion, an increase of 5.8% year-on-year.

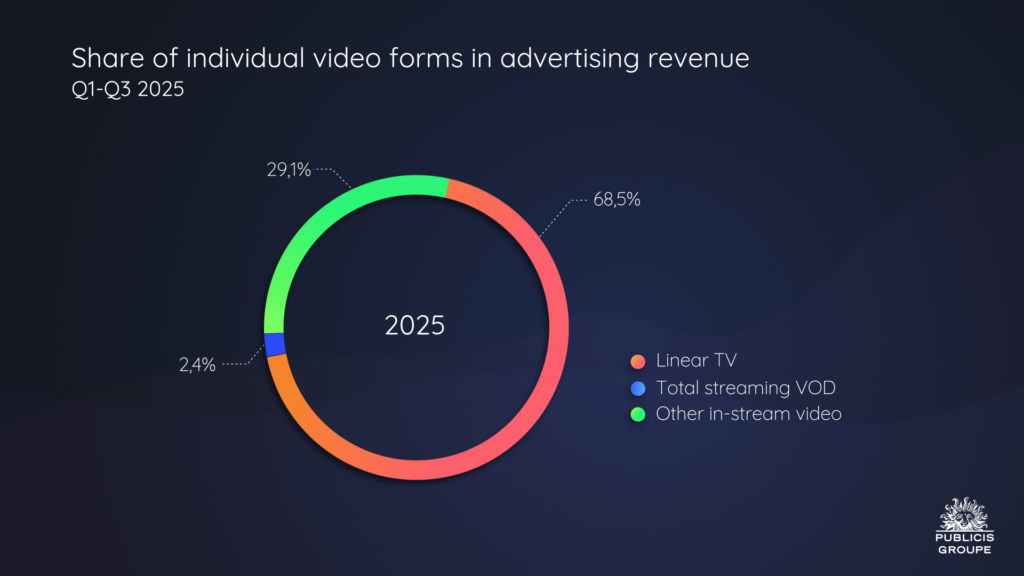

Among the video segments, linear TV consistently has the largest revenue share (68.5%). At the same time, we have seen a further 3.5 p.p. decrease in share compared to the same period last year. In the analysed period, advertising investment in this medium increased by just 0.7% year-on-year in 2024.

The second video segment, in terms of revenue share (29.1%), is other in-stream video, comprising two components: video on social media platforms YouTube, Meta, and TikTok, and short-form video on online portals. Social media video advertising investment growth was 16.5 %. Publicis Groupe analysts also noted an 18.4% increase in short video ads on websites between January and September 2025.

The total streaming VOD segment (video-on-demand services: BVOD, HVOD, and other VOD) has steadily increased its share of the overall video ecosystem, from 1.7% last year to 2.4% today. A definite contributor to this is the increase in advertising offers and the launch of new services that offer viewers ad-supported subscriptions, as well as modern channels in the FAST model. In terms of advertising revenue, VOD streaming grew by 52.4% year-on-year in the period under review.

Chart 5. Share of individual video forms in advertising revenue after three quarters of 2025.

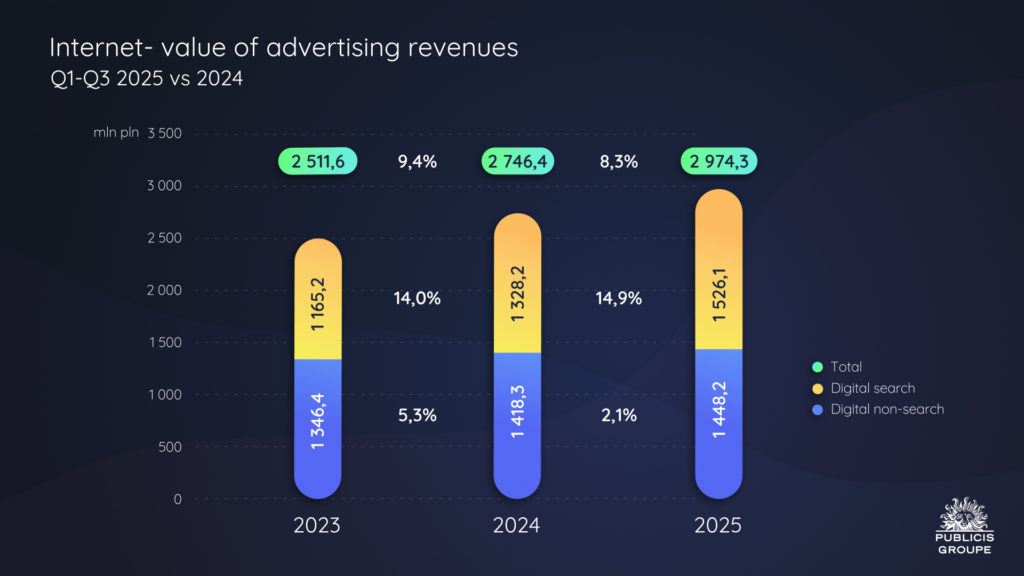

According to Publicis Groupe’s analysis, the value of Internet advertising investment in a new perspective, i.e., excluding online video (not including ad spending), amounted to PLN 3 billion from January to September 2025, up 8.3% year-on-year. The Internet’s share of the advertising market in the period was 30.9% (0.5 p.p. higher year-on-year).

According to estimates from Publicis Groupe analysts, over the three quarters of 2025, revenues in the digital search segment grew by 14.9% year-on-year and continue to contribute most significantly to growth in revenues across the internet.

From January to September 2025, digital non-search advertising achieved 2.1% growth, year-on-year. Over 92% of this online segment is display advertising, for which we estimated advertising revenue growth of 2%. The main driver of growth in digital non-search advertising is display formats on Meta’s social networks. After three quarters of 2025, the rate of investment in these formats has increased above 13%.

Chart 6. Internet: value of advertising revenues, 2025 vs 2024

According to Publicis Groupe analysts, investment in radio advertising increased by 7.8% in the first three quarters of 2025, or by PLN 47.6 million in volume terms. From January to September 2025, ten sectors increased their advertising investments in radio. The leader of the radio market is commerce, which recorded the largest increase in budget volume: by as much as PLN 24.4 million (an 8.4% increase). Second place went to the automotive sector, with an increase of PLN 14.6 million (a dynamic of 27.3%). In the first three quarters of 2025, the audience share of the Eurozet Group, Polish Radio and Audytorium 17 declined, while the RMF Group, TIME and other smaller broadcasters saw increases. The unsurpassed leader of the radio market remains the RMF Group with an increase in listenership of 0.4 p.p. year-on-year. Eurozet Group’s listenership share fell by 0.8 p.p . The RMF Group’s result was undoubtedly influenced by its main station, RMF FM, whose share rose by 0.6 p.p., the most significant increase among all radio stations in the period under review. Radio TOK FM, on the other hand, recorded the biggest fall in its share of listening time – by 0.5 p.p. In third place was TIME Group, whose listenership share fell by 0.4 p.p. (Source: Kantar)

In the first three quarters of 2025, advertising investments in outdoor advertising were 6.0% higher than a year ago, meaning by nearly PLN 34 million. As in the previous year, this growth was generated primarily on digital media. The Chamber of Commerce’s OOHlife analysis and ours show that the share of digital media in advertising revenues increased from 27.4% to 29.4% in 2025 in the analysed period. The largest volume increase in advertising investment was recorded for the automotive sector – by PLN 7.9 million (a dynamic of 70.6%), to which the campaigns of Orlen, Audi and Land Rover largely contributed. In second place was finance, with an increase of PLN 5.9 million (a dynamic of 70.5%).

Net advertising revenues in cinemas amounted to nearly PLN 142.8 million between January and June 2025 in the period under review, representing 9.1% year-on-year growth. The top five sectors with the largest share of investment in cinema advertising were: media, automotive, food, leisure and finance. In terms of growth volume, the food sector stood out, increasing its investment in cinema advertising by almost PLN 4.3 million (a dynamic of 35.6%). However, the largest decline in the volume of the cinema advertising budget was recorded in the commerce sector – advertisers from this sector reduced their spending by over PLN 4.3 million (a dynamic of -31.3%).

Between January and September 2025, investments in magazine advertising fell by 1.5% year-on-year, or nearly PLN 1.5 million. The total number of advertising pages in magazines decreased by 16.8%. (Source: Kantar). In terms of volume, the largest reduction in advertising investment occurred in the Other sector, with a particular drop in expenditure by foundations, associations and political institutions, and in building materials. Companies and organisations in this sector spent PLN 1.8 million less on advertising (a dynamic of -15.6%). The sector with the highest volume growth is pharmaceuticals and medicines (up by PLN 1.5 million, growth rate of 7.8%).

Investment in advertising in daily newspapers from January to September 2025 increased year-on-year by 0.4%, or PLN 0.3 million, to PLN 71.2 million. The biggest decline was in the finance sector, which reduced its advertising investment in newspapers by PLN 2 million (a dynamic of -27.5%). Publicis Groupe analysts recorded the largest volume increase in the case of media sector advertising budgets, by PLN 2.7 million (83.8% growth rate).

MEDIA’S SHARE OF ADVERTISING REVENUE

As a consequence of the varying dynamics of change across the different media classes, their market shares are also changing. The share of video (TV, streaming VOD and other in-stream video) fell from 53.2% to 52.8%, while the share of internet (digital search and non-search) in the media mix increased by less than 0.5 p.p. from 30.4% to 30.9%. Together, video and the Internet account for 83.7% of the total advertising market. There was a slight increase in the share of cinema: from 1.4% to 1.5%. For radio and out-of-home advertising, the shares remained at last year’s levels: 6.8% and 6.3%, respectively. In contrast, magazines and newspapers saw their share of the media mix fall by 0.1 p.p. to 1.0% and 0.7% respectively.

Chart 7. Share of media classes in the advertising market, 2025 vs. 2024